Billionaire Sam Zell just announced that he bought gold for the very first time in his life because, as he puts it, “it is a good hedge.” In a recent Bloomberg interview, the Equity International founder and creator of the real estate investment trust (REIT) admitted to seeing an opportunity in gold’s increasing supply shortage.

“For the first time in my life, I bought gold because it is a good hedge,” Zell, 77, told Bloomberg. “Supply is shrinking, and that is going to have a positive impact on the price.”

He added:

“The amount of capital being put into gold mines is at most nonexistent. All of the money is being used to buy up rivals.”

I believe Zell’s reasons for investing in gold are sound, and I’ve discussed them in detail a number of times before. Supply is indeed shrinking. The “low-hanging fruit” has likely already been mined, and it’s become prohibitively expensive for many companies to look for large-scale deposits, to say nothing of developing them. As you can see below, the number of ounces in major discoveries has been falling for years, and exploration budgets are still far below the 2012 peak.

We Believe Supply-Demand Fundamentals Look Constructive

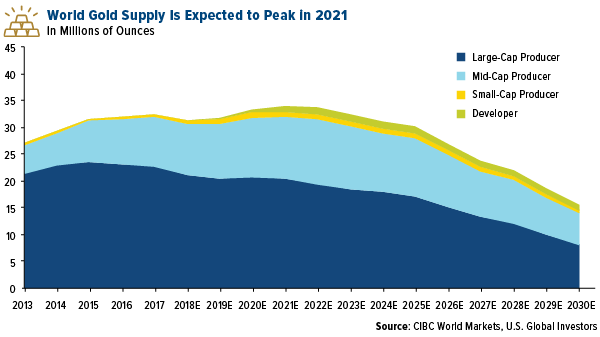

As if to confirm Zell’s reasoning, the Canadian Imperial Bank of Commerce (CIBC) forecast in a report this week that a gold deficit will emerge in 2019 “on the back of stronger demand over the next two years, primarily from bar hoarding, net central bank buying and exchange-traded products (ETFs).” Peak production, according to the bank, will occur in 2021 at close to 34 million ounces, but then decline to under 16 million ounces by 2030.

Demand isn’t abating, though. We’re seeing appetite grow for the precious metal, not just from investors but also central banks, which have been net buyers since 2010. According to CIBC, several central banks stepped back into the market last year, most notably the Reserve Bank of India (RBI), which until recently “has expressed negative sentiment around gold purchases.”

CIBC raised its gold price forecast this year to $1,350 an ounce, up from $1,300. The bank is also looking for $1,400 an ounce in 2020.

But These Gold Miners Could Be Even More Effective as a Store of Value

As attractive as I think gold bullion looks right now, there could be some incredible opportunities in gold equities, which are extremely discounted compared to the S&P 500 Index.

Among CIBC’s favorite gold equities are Agnico Eagle, Wheaton Precious Metals, B2Gold and SSR Mining—all of which we own in either our Gold and Precious Metals Fund (USERX) or World Precious Minerals Fund (UNWPX).

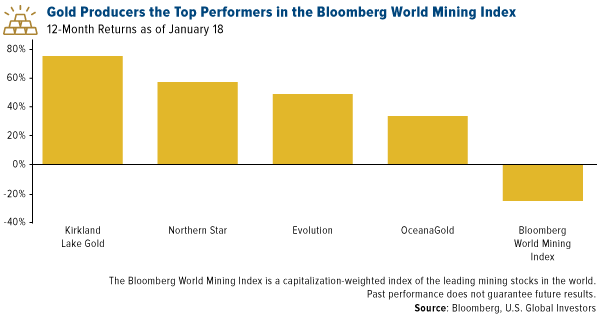

And in an article dated January 22, Bloomberg analysts David Stringer, Ranjeetha Pakiam and Danielle Bochove point out that a good place to look for gold equities could be mid-sized producers, which have outperformed both bullion and the entire global mining industry. For the 12-month period as of January 18, four miners in particular—Kirkland Lake Gold, Northern Star, Evolution and OceanaGold—all posted double-digit performance. By contrast, the Bloomberg World Mining Index was down more than 20 percent.

Northern Star, one of the top holdings in USERX as of December 31, was up 54 percent for the 12-month period. The Australian producer had a phenomenal fiscal year 2018, with net profit up a respectable 3 percent even as the price of gold was in decline. Dividend payouts were raised 6 percent. And the company continues to carry no debt.

Consolidation in the Goldfields

Sam Zell’s other point—about miners allocating their capital not to projects right now but to acquisitions—is also well-made. Indeed, industry consolidation is beginning to happen, which could possibly signal that the industry has found a bottom. Back in September, mining giants Barrick Gold and Randgold Resources announced a deal worth $6.5 billion, making the world’s largest gold producer by annual output. That record will stand for only four months, as Newmont Mining just made public its own plan to buy rival Goldcorp for $10 billion.

The next deal to surface could be nearly as large. It’s now rumored that South African producers Gold Fields and AngloGold Ashanti are interested in merging. Although the rumor has not yet been confirmed, Gold Fields CEO Nick Holland said in an interview this month that “if you are going to survive in the long term, you are going to have to look at consolidation.”

With combined output of 6 million ounces in 2017, a Gold Fields-AngloGold merger would create the world’s third largest producer after Newmont-Goldcorp (7.9 million ounces) and New Barrick (6.6 million ounces).

Gold Fields, which we own in the Gold and Precious Metals Fund (USERX), was up as much as 4.19 percent in New York trading on Tuesday on the news. From its 52-week low in September, the South African company has now risen a remarkable 78 percent.

Curious to see what other companies round out the Gold and Precious Metals Fund and World Precious Minerals Fund’s top 10 holdings? Learn more by clicking here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and timberlands.

The S&P 500 Index (Standard & Poor’s 500 Index) is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value, The index is widely regarded as the best single gauge of large-cap U.S. equities.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund and World Precious Minerals Fund as a percentage of net assets as of 12/31/2018: Agnico Eagle Mines Ltd. 1.65% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund; Wheaton Precious Metals Corp. 2.50% in Gold and Precious Metals Fund, 0.20% in World Precious Minerals Fund; B2Gold Corp. 0.51% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund; SSR Mining Inc. in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund; Kirkland Lake Gold Ltd. 0.00% in Gold and Precious Metals Fund and World Precious Minerals Fund; Northern Star Resources Ltd. 4.56% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund; Evolution Mining Ltd. 0.00% in Gold and Precious Metals Fund and World Precious Minerals Fund; OceanaGold Corp. 0.00% in Gold and Precious Metals Fund, 0.03% in World Precious Minerals Fund; Gold Fields Ltd. 1.03% in Gold and Precious Metals, 0.00% in World Precious Minerals Fund; AngloGold Ashanti Ltd. 0.00% in Gold and Precious Metals Fund and World Precious Minerals Fund.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.