Source: The Critical Investor for Streetwise Reports 01/21/2019

The Critical Investor profiles a company that he believes is “one of the more remarkable gold exploration stories around.”

1. Introduction

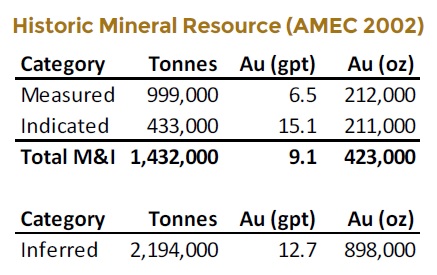

After a year which saw not a lot of enthusiasm in the mining sector to put it mildly, topped off by a resulting brutal tax loss selling season, sentiment for mining and gold in particular seems to be recovering, so in my view it is time to look at one of the more remarkable gold exploration stories around. Rise Gold Corp. (RISE:CSE; RYES:OTCQB), a small junior headquartered in Vancouver, is looking to find gold in, around and below the past-producing high grade Idaho-Maryland gold mine in California. This project contains a considerable historical (2002) high grade estimate done by Amec Foster Wheeler of 0.4 Moz @ 9.1 g/t Au M&I and 0.9 Moz @ 12.7 g/t Au Inferred, or a more recent one by Pease in 2009, estimating 472 Koz @ 10 g/t Au M&I, and 1 Moz @ 12 g/t Au Inferred.

Personally I consider Amec by far the most reputable engineering firm globally, and therefore I mention their estimate, although it is firmly outdated. Of course both estimates aren’t NI 43-101 compliant as both are not recent enough, using today’s QA/QC procedures, but it provides a first indication of mineralized potential. These estimates are historical, non-compliant and outdated, but aren’t hot air at all in my opinion, as the Idaho-Maryland Mine had to halt production in 1954 when it was nowhere near depletion.

The company has analyzed all available historical data, constructed all sorts of (3D) models, maps and sections, defined targets, raised cash and has completed its 2018 drill program, and is setting up for its 2019 drill program after raising C$2.5 million in the last quarter. As Rise has to drill pretty deep most of the time (600–1800m), progress hasn’t always been easy and quick, but as the company doesn’t seem to have any problem reeling in strategic investors like Yamana and Southern Arc, the quest for gold continues. Let’s see what the potential is for investors.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Company

Rise Gold Corp is a U.S. exploration and development company with Canadian headquarters, focused on creating shareholder value through advancing a gold project in California. The company is developing an exploration strategy for its fully owned Idaho-Maryland gold project, a former past producing mine located in Grass Valley, California.

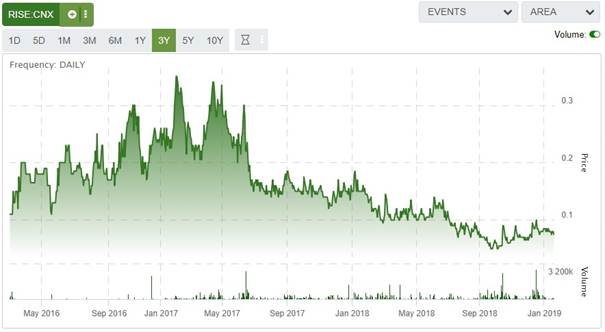

Rise Gold currently has 145.99 million shares outstanding (fully diluted 240.709 million), 80.06 million warrants (the majority is due @ C$0.10–0.15),and several option series to the tune of 14.51 million options (C$0.18 on average) in total, which gives it a market capitalization of C$10.95 million based on a January 17th share price of C$0.075. The company has no trouble raising cash despite its CSE listing, as it raised C$0.35 million in September 2018, and C$2.5 million in November 2018. As a consequence, their treasury contains about C$3 million at the moment, which is enough for this year’s drill program. Waning mining sentiment and few results didn’t go unnoticed for Rise shareholders, as can be seen here:

Share price; 3 year time frame

Although gold has seen significant gains on a dropping U.S. dollar, and sentiment improved somewhat as usual after tax loss selling season, Rise hasn’t been following suit quite typically. One reason for this could be that the company is still flying very much under the radar, but the share price also seemed to experience support from the November raise, bringing on board intermediate producer Yamana Gold and seeing Southern Arc reinforcing their holdings in Rise. That way the share price was prevented to drop off mid-December as most mining stocks did, but on the other hand wasn’t able to recover lost ground as there wasn’t much lost ground to make up for. In my view at such lows it seems the bottom is in at C$0.05, and any significant drill result could very well support a higher share price soon, as the market cap is still small at around C$10 million.

The management team is led by President and CEO Ben Mossman, who knows all about underground gold mines in North America with over 15 years of experience as a mining engineer under his belt (Snap Lake Mine for DeBeers Canada, Bellekeno Mine for Alexco Resource Corp). Since Southern Arc bought into its first strategic position, several positions have been filled by staff related to Southern Arc, not only in the Board of Directors but also management and the advisory team. This could evolve into a nice potential one-two, where maybe Southern Arc gets the benefits of a higher return at a hypothetical Yamana buyout. Key person in all this is John Proust, CEO of Southern Arc. Interesting names are director Bob Gallagher and former director and current advisor Alan Edwards.

Last but not least is director Thomas Vehrs, who is a huge asset in determining the right exploration strategy. Holding a PhD in geology, Dr. Thomas Vehrs is a highly regarded and experienced exploration geologist with over 40 years of experience in the Americas. For the past ten years, Dr. Vehrs held the position of VP Exploration for C$740 million market cap Fortuna Silver Mines.

3. Idaho-Maryland project

Rise Gold has one project, the Idaho-Maryland Gold project, located in Grass Valley, Nevada Country, in the state of California. Grass Valley deposits are classified as a gold quartz vein type deposit, often higher grade and extending at great depths. California didn’t exactly build the best reputation as a mining friendly jurisdiction over the years, caused predominantly by permitting issues. Because of it, the state is ranked #61 out of 91 jurisdictions worldwide on the Policy Perception Index by the latest Fraser Survey at the moment, which basically reflected 2017. However, a lot has changed since Trump took over, as he is pro-mining and anti-permitting. Furthermore, a few mines have been permitted in the last few years in California, also before Trump, Nevada County would be the lead agency and not the state of California, and in addition to this the project is located on private land, which makes permitting much easier compared to federal (BLM) land, as stated in the technical report:

“The Project area is covered by private land and no permits or consultations with the US Bureau of Land Management (BLM) or the US Forest Service (USFS) would be required.”

Because of all this I view permitting risk for Rise Gold as manageable.

The former Idaho-Maryland Mine has a long past behind it. The mine was reportedly the second largest gold mine in the United States in 1941, producing up to 129,000 oz gold per year before being forced to shut down by the U.S. government in 1942 due to World War II, as the workforce was needed in war efforts. Significant production after the war-time shutdown never occurred.

As mentioned earlier, there is a historical resource estimate completed in 2002 by Amec, using a cut-off grade of 3g/t Au (for correct and full disclosure see company documents, as one cannot rely on a historical resource estimate):

A few more historical resource estimates have been completed since then, the most recent being the one by Pease in 2009. They estimated 472 Koz @ 10 g/t M&I, and 1 Moz @ 12 g/t Au Inferred, based on a 1.44 Mine Call Factor multiplier (the grade at the mill head was much higher than the sampling grade, so a correction factor was applied). No historical, non NI 43-101 compliant resource estimate can ever be relied upon as mentioned, so keep this in mind.

The underground workings of the former Idaho-Maryland Mine are flooded, and it would cost a lot of time and money to dewater this just for drilling, as the underground workings are extensive. The company had the New Brunswick shaft inspected with a remote operated vehicle to a depth of 701m (full depth over 1,000m), to see if it was intact.

It appeared the shaft was open over the inspected length, and the woodwork appeared to be in good condition. This could be important for future development, being either deep drilling or mine development, as constructing a new shaft is a costly business (for this size and depth easily a US$40–50 million). The historical hoisting capacity was 75t/h, so this means a full-time 1,800 tpd, which would be more than enough for such an operation. Management thinks this can be increased if needed at today’s standards, without the need to widen the shaft. Notwithstanding all this, as underground workings are flooded, exploration needs to take place from surface, demanding deep drilling, which is expensive, although management elected to buy two drill rigs for C$611,000 in June 2018 to save on ongoing drilling costs, one of them among the most powerful rigs available on the market these days.

Rise Gold also bought quite a bit of land surrounding the mine for different future mine purposes, as can be seen here:

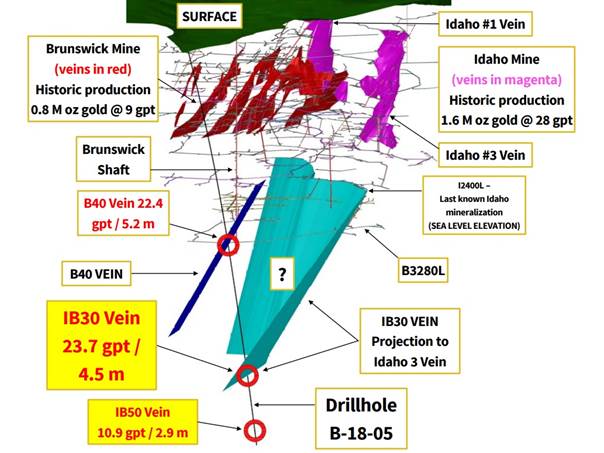

To get a bit of an impression about the Idaho-Maryland Mine itself, here is a 3D view of the different underground workings, ranging from surface to a depth of -1650 ft (about -550m), with the mined out historical mineralization in red and magenta:

Some of the deepest drill results are reported from below 1800m. Please note that the nearby former Empire-Star Mine had underground workings going as deep as 1,600m, which is almost as deep. This mine was shut down due to a labor strike, and also contained significant reserves, and is still owned and shelved by Newmont.

4. Drill Results

As the operators were mining three separate, rich veins (Idaho #1 and #3, Brunswick) and ramping up to double the production to 250,000 oz before WWII halted everything in the past, it will be understandable that numerous exploration targets in and around the mine workings were already identified during and after operation in those days.

The 2002 Amec report lists the characteristics of typical orogenic gold deposit types, as Idaho-Maryland falls in this category, and here are some very relevant and interesting highlights:

1. “Tabular fissure veins in more competent host lithologies, veinlets and stringers forming stockworks in less competent lithologies. Typically occur as a system of en echelon veins on all scales.”

2.”Vein systems may be continuous along a vertical extent of 1–2 km with minor change in mineralogy or gold grade; mineral zoning does occur, however, in some deposits.”

Orogenic gold deposits can also have their disadvantages, as they can be hard to delineate, also due to possible nugget effects and narrow veins at depth. Fortunately for Rise Gold, Idaho-Maryland is something special in this regard:

3.”Past production at the Idaho-Maryland Mine has demonstrated significant vertical and horizontal continuity of the veins. The great vertical extents of veins of similar gold deposits, such as the adjacent Empire Mine, suggests extensions of the #1 Vein, 3 Vein system, and the Brunswick Veins to depth and there exists potential for significant stockwork-style mineralization within the Brunswick Block.”

Keep the remarks about stringers, en echelon veins, vertical extent of 1-2 km, and great vertical and horizontal continuity of veins in mind, when actual drill results will be discussed later on.

As the Idaho-Maryland system is probably too deep and complex to drill out completely (to Reserves) from surface, the strategy of Rise Gold will be exploration and in the end delineation to Indicated and Inferred Resources, probably on a grid spacing of 50m. Drill costs are estimated by the company at ~$140/m all-in, now that it owns the rigs themselves. Otherwise the costs would have been US$240–300/m all-in. Because of considerable depth, management may use directional drilling, with a few widely spaced, deep motherholes first after which multiple branch holes will be drilled.

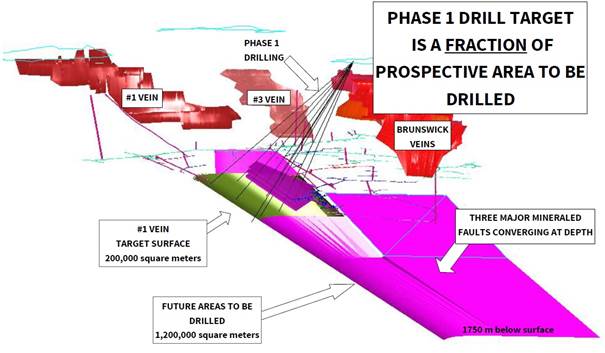

The currently most significant exploration targets identified at the Idaho-Maryland Gold Project are in untested ground below the historical mine workings. These targets are extensions of the Idaho #1 Vein, Brunswick, 3 Vein System, and the Crackle Zone.

The Crackle Zone, a concept initiated by renowned geologist and Hall of Famer Alan Bateman a long time ago, could prove to be the theory that might propel the Idaho-Maryland project into Tier I territory if correct. It basically envisions a converging feeder structure to all currently know mineralized zones, located below them and continuing at depth.

The size of this wedge could have an average width of 400m, average thickness of 5m and a length of 900m, creating a volume of 31.6M m3. Based on a gravity of 2.75 t/m3, the Crackle Zone target could be 5 Mt, which is sizeable of course. If this Zone indeed proves to be the converging point of the other zones, I wouldn’t be surprised if the total resource could pan out to be 1-2 Moz or even larger.

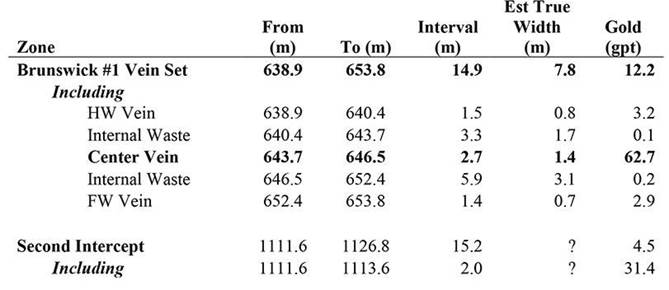

Let’s see what results the drilling has provided us so far. The first results that came back are shown here:

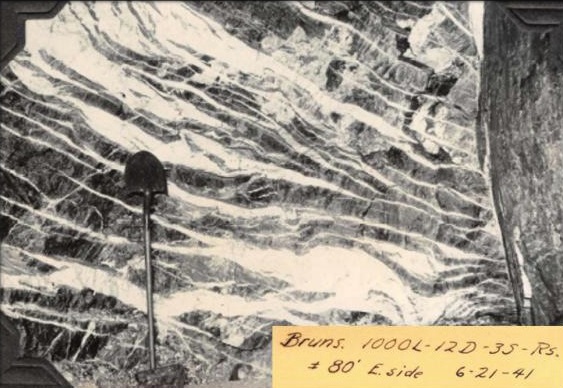

It was a narrow intercept, but very high grade, in line with historical mineralization, which is in large part narrow vein based. This is how things typically look down below:

According to management, the first deep hole was aimed at the Idaho #1 target, designed to be drilled between the mined stopes (voids) on the Brunswick veins so that the crew wouldn’t have to drill through open voids, which can be difficult. Unfortunately they missed as the hole deviated into the other direction than expected, and a new hole was drilled.

The news release also contained a pretty interesting bit of information:

“Assay data from the Drillhole indicates that the highest gold grades in the composites are located in the wall rocks immediately adjacent to the quartz vein, rather than in the quartz veins themselves.

The company’s observation that the wall rocks of the quartz veins hosts high grade gold could have major implications to the interpretation of the historic data from the mine. In most cases, the historic operator reported drill core and channel sample assay results for only intersections of quartz and rarely conducted sampling of the adjacent material. If there are important gold values in the adjacent wall rock, the historic sampling would have greatly underreported the gold grades of the mineralized veins.”

If the engineering firms like Amec and Pease also used quartz vein based mineralization for their estimates, things could get fascinating as drilling progresses.

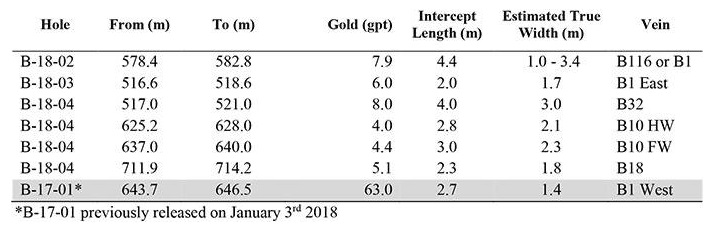

The concept of mineralization being located close to the (mined out) quartz veins appeared to continue with the next set of drill results, especially at the Brunswick East Block target veins:

“Drill hole B-18-04 was the first drill hole to test below the multiple parallel veins mined on the eastern side of B1600 level. This drill hole intersected four veins with significant gold values.

On the B32 Vein, an intercept of 8.0 gpt gold over 4.0m was intersected east of the historic mine workings, between the B1300 and B1450 levels. In addition to the downdip potential of the B32 Vein, this intercept highlights the potential of significant mineralized material remaining in the levels above B1600 level, in and around the historic mine workings and stopes.

On the B10 Vein, two closely spaced veins assayed 4.0 gpt gold over 2.8m and 4.4 gpt gold over 3.0m. The two intercepts are located immediately below the B1600 level. Historic mining (stoping) occurred along the B1600 level, immediately above the intercepts.”

For clarity, the mentioned 1600 number is 1,600 feet below ground level, which is slightly over 500m. The results above are an example of the mentioned en echelon vein sets, and there are many of those, mined and currently being discovered. Because of these results, management expects that former operators have left a lot of mineralization at these levels, which aren’t very deep relatively speaking.

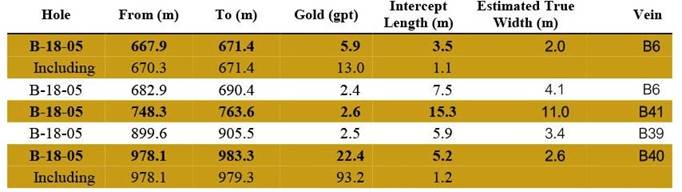

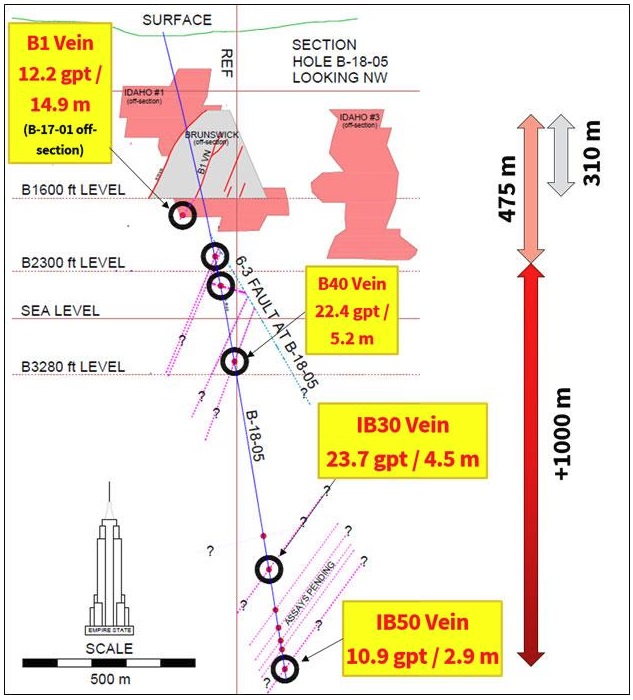

The next drill result also handled the Brunswick vein system, and reported B-18-05, again containing multiple mineralized intercepts, indicating several stacked veins:

Visible gold was also detected in the B40 vein, and management was excited to see wider mineralization as well. The average grade of this vein didn’t surpass economic viability in itself, but it could be an interesting “pathfinder” vein, leading up to better mineralization. This hole returned more mineralization at great depth:

These intercepts are both economic although very narrow. Again, the minimum mining width is 2m, so average grades of 46 g/t and 30.5 g/t over 2m is very good.

It got CEO Mossman to comment on the results like this:

“These deep drill intercepts demonstrate the large exploration potential of the Idaho-Maryland Gold Project. To be able to hit deep high-grade gold mineralization with a single blind hole speaks to the great strength of this gold system. Rise has intersected multiple zones of important gold mineralization in all five holes completed to date. This deposit is known for hosting exceptionally continuous gold veins and every drill hole reinforces our belief that the Idaho-Maryland is one of the most exciting high-grade gold projects in America.”

Usually with these very short intercepts it is a case of nuggety mineralization, but as Amec mentioned in its reported, the type of mineralization of these deposits tends to be very continuous and extends very deep. This is exactly what we are seeing now, and this gets management excited as well.

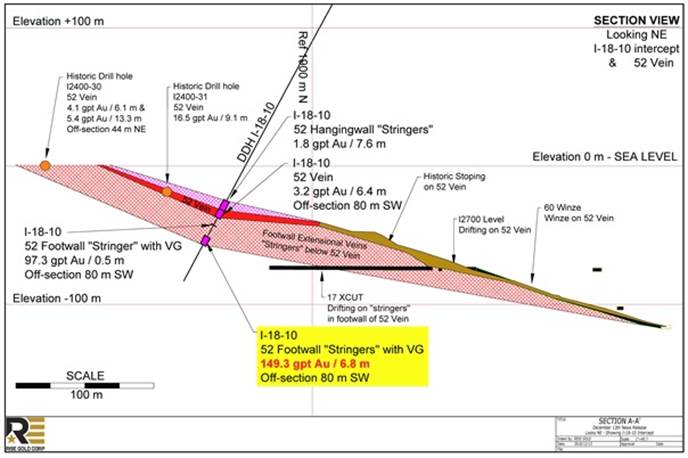

To get a bit of a visual on the results so far, here is a section:

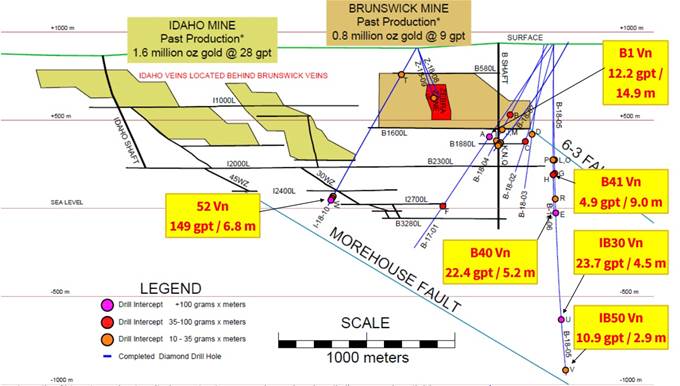

It might be that Rise Gold hit the earlier mentioned converging feeder structure at depth, as conceptualized by Bateman many years ago. In a long section also including the latest intercepts, things are shown like this:

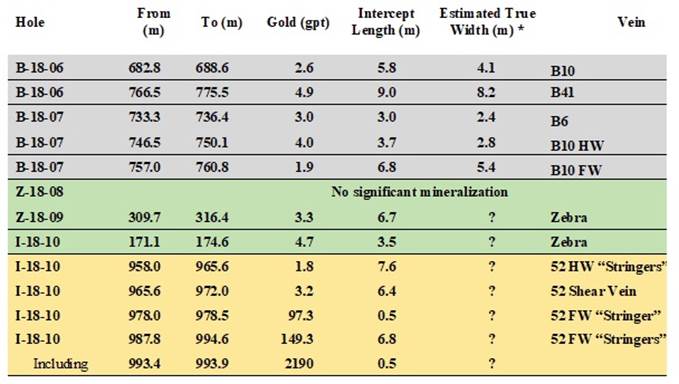

This is all very encouraging in my view. Bit by bit the story gets more and more interesting, only reinforced further by the latest set of results, released on December 13, 2018:

For the first time the company intercepted the earlier mentioned stringers with visible gold, and again when recalculating the high grade 0.5m intercept for a minimum 2m mining width the resulting grade is very economic at 547.5 g/t. An intercept of 6.8m @ 149.3 g/t would have been very good as it implies more continuity (veins have a tendency to pinch and swell a lot), but the beauty of this type of geology is that the continuity is very good. As the shorter intercept (0.5m @ 2190 g/t) contains more gold than the longer intercept (6.8m @ 149.3 g/t) which it is part of, I asked CEO Mossman for an explanation. He stated that they rounded the widths in the news release to one decimal. The work done at site is in feet. So this interval was 1.5 ft, which is 0.457 m. Since the assay is so high this couple centimeters causes the rest of the interval to show as a negative grade in a calculator. We will post the results to 2 decimals in the future. I pasted the interval into the doc below so you can see the entire detail:

|

HoleID |

SampleID |

From |

To |

Length |

Description |

Au_ppm |

|

I-18-10 |

Y973269 |

987.765 |

988.299 |

0.533 |

Irregular qtz veining with strong alteration/pyritization |

5.56 |

|

I-18-10 |

Y973270 |

988.299 |

988.847 |

0.549 |

As above |

10.20 |

|

I-18-10 |

Y973271 |

988.847 |

989.823 |

0.975 |

Scattered veinlets, weak alteration |

1.92 |

|

I-18-10 |

Y973272 |

989.823 |

990.783 |

0.960 |

Single narrow qtz carb vein, weak pyritization. |

1.26 |

|

I-18-10 |

Y973273 |

990.783 |

991.911 |

1.128 |

Scattered veinlets, weak alteration. |

0.02 |

|

I-18-10 |

Y973274 |

991.911 |

992.901 |

0.991 |

As above |

0.00 |

|

I-18-10 |

Y973276 |

992.901 |

993.419 |

0.518 |

As above |

0.79 |

|

I-18-10 |

Y973277 |

993.419 |

993.877 |

0.457 |

3cm qtz vein with much visible gold. 10% pyrite in wallrock |

2190.00 |

|

I-18-10 |

Y973279 |

993.877 |

994.578 |

0.701 |

Qtz carb veinlets; weak alteration |

5.20 |

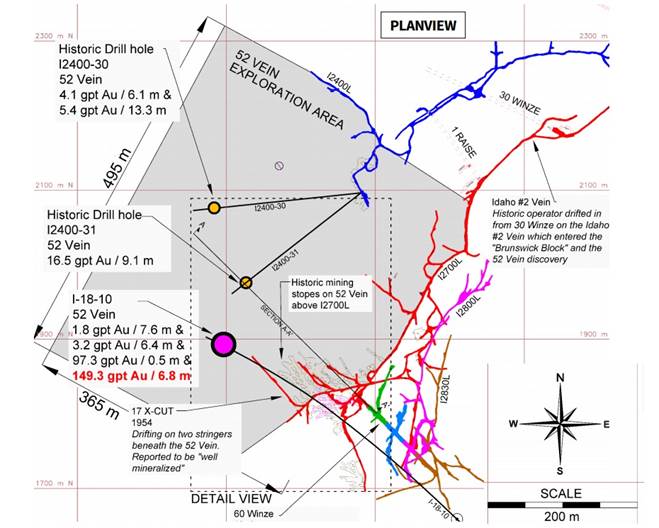

On a map, the location of the latest drill results of the 52 Vein target can be visualized:

Not all results are that good, but keep in mind that the nearby historical results (6.1m @ 4.1 g/t, 13.3m @ 5.4 g/t and 9.1m @ 16.5 g/t) are certainly economic, providing a vein strike length of at least 100m at this location.

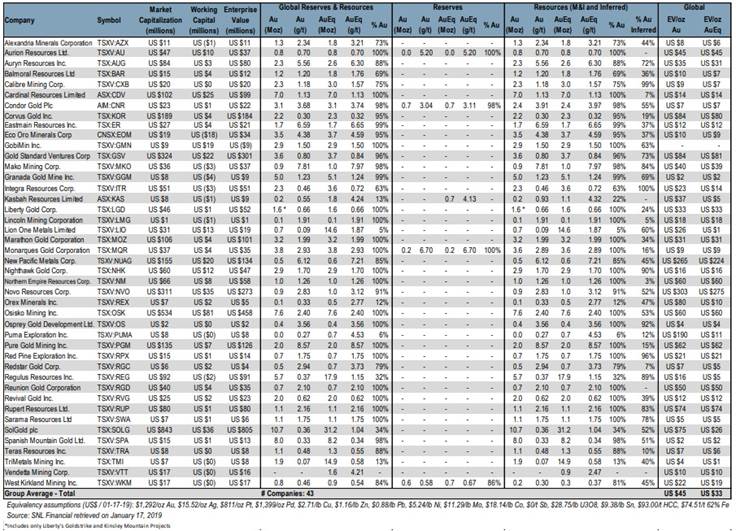

This drilling at depth takes up a lot of time and resources, but if Rise Gold manages to come close to the historical resource estimates, let’s say they prove up 1 Moz of high grade mineralization, a re-rating can be expected, as its EV per oz would be in the range of US$10–15/oz, assuming more dilution. The average for this metric for explorers with a resource currently hovers around US$45/oz, according to this Haywood Securities table, part of its most recent Weekly Dig update:

This table contains outliers in both directions, so I believe this figure to be pretty accurate. If the directional drilling of Rise Gold proves to be successful, and a 1 Moz resource is in the cards, then I don’t see a reason why this stock wouldn’t at least double from here. Management is convinced there is much more gold left in the old underground workings and below this, it’s up to them to show the world what the Idaho-Maryland really contains at depth.

5. Conclusion

After completing 11,610 m of drilling, it appears that Rise Gold is hitting gold everywhere it looks. This in itself is pretty rare, and especially the economic intercepts at depth indicate large mineralized potential. Historical resource estimates point into the direction of 1 Moz, but management thinks there could be more. The Rise Gold story with its roots in the fascinating, distant past is coming together nicely now, after hitting lots of veins, acquiring two rigs, raising lots of cash, attracting two strategic parties of which one is well-known producer Yamana Gold, and assembling a very experienced group of people. Because of the deep exploration, things will likely not advance very quickly, but with this type of backing there will be no shortage of financial and technical support, and Rise Gold should be able to advance Idaho-Maryland slowly but surely into a significant deposit in my view.

Former Idaho-Maryland Mine; Brunswick mine shaft

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The Critical Investor Disclaimer:

The author is not a registered investment advisor. Rise Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.risegoldcorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

( Companies Mentioned: RISE:CSE; RYES:OTC,

)