South Africa’s Gold Fields (JSE:GFI) (NYSE:GFI) on Tuesday denied a report by Bloomberg speculating that the company wants to combine with rival AngloGold Ashanti.

“This article is factually incorrect and we completely disassociate ourselves with this statement,” Gold Fields said in a statement.

Earlier Bloomberg published an article outlining a $8 billion tie-up quoting “a person familiar with the matter”:

Gold Fields believes it would be the ideal combination as the two miners operate in similar jurisdictions and have a shared philosophy, said the person, who asked not to be identified because the information is private. Discussions haven’t taken place yet, the person said.

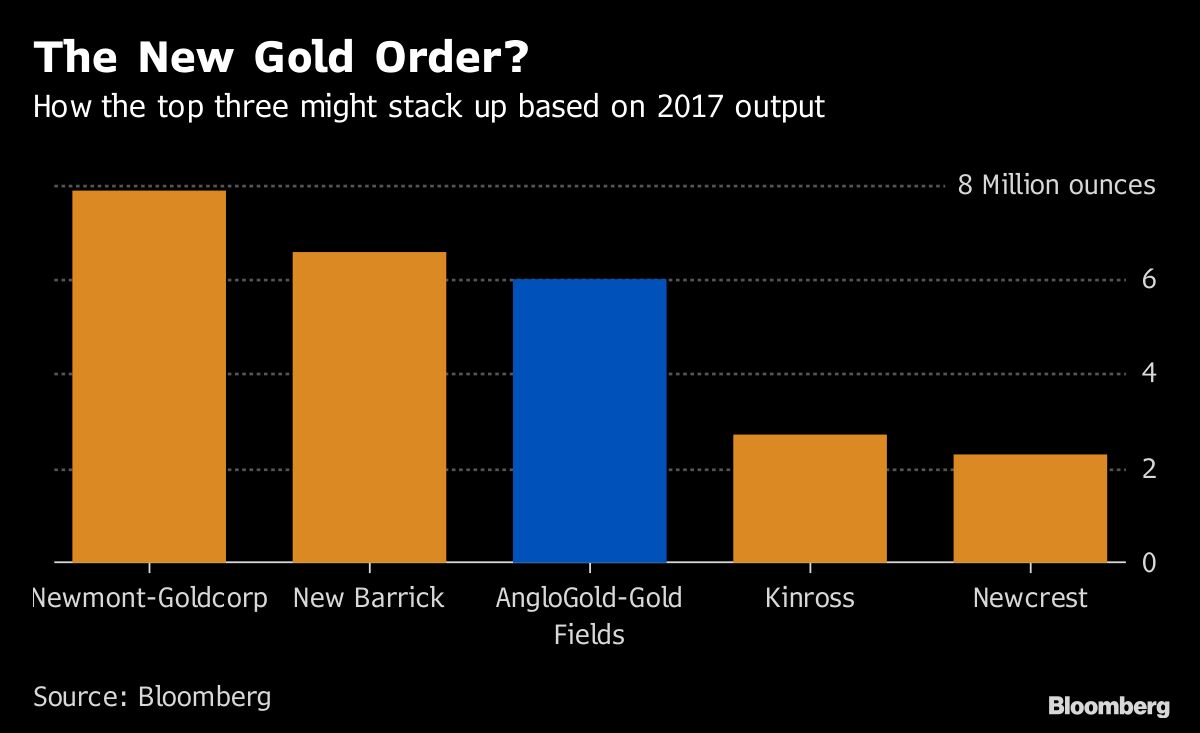

The enlarged company could produce almost 6 million ounces of gold a year, closing the gap on Newmont Mining and Barrick Gold which have both announced mega deals, Bloomberg reported.

If you are going to survive in the long term, you are going to have to look at consolidation,” Gold Fields Chief Executive Officer Nick Holland said in a Jan. 15 interview.

A tie-up would allow the two Johannesburg-based producers to repackage their troubled South African mines together for a potential sale should a buyer be found, the person said.

It’s not the first time a combination of the two companies has been proposed. The Gold Fields CEO was reported in April 2010 to be open to consolidation with AngloGold. The two miners also weighed a merger in September 2006 according to Bloomberg.

The post Gold Fields dismisses AngloGold merger report appeared first on MINING.com.