Source: Peter Epstein for Streetwise Reports 01/17/2019

Peter Epstein of Epstein Research discusses the strategic investment this gold explorer just received.

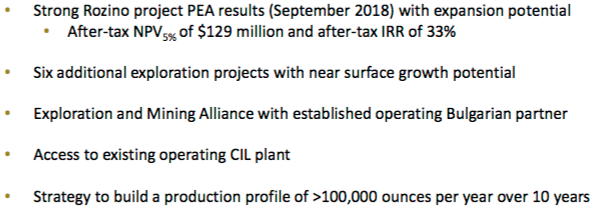

Velocity Minerals Ltd. (VLC:TSX.V; VLCJF:OTCQB), the Bulgarian gold exploration and development company, with a strong PEA on its Rozino project, and six additional near-surface gold prospects, announced a key strategic investment by Atlantic Gold Corp. (TSX-V: AGB; OTCQB: SPVEF).

A Vote of Confidence in Velocity Minerals

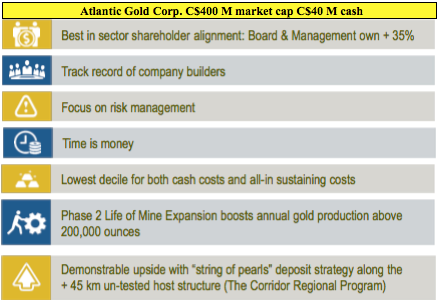

Atlantic Gold is a C$400 million company with proven mine building capabilities. It produced 90,531 ounces of gold in 2018 at a very low all-in sustainable cost of US$521–US$566/oz. The mine was built on time and on budget and production metrics are exceeding Feasibility levels. The mine is being expanded to 200,000 ounces/year.

This is a significant de-risking event for Velocity as it will receive a C$3.9 million equity investment at a premium to its market price, plus a C$5.1 million 5-year secured 8.5% convertible bond investment with a conversion price of C$0.25/share (a 35% premium). The convertible bond has no strings attached (no warrants or other equity kickers). In total Velocity will receive C$9 million from Atlantic Gold.

Velocity CEO Keith Henderson stated, “We are delighted to welcome Atlantic Gold as a strategic investor in the company. Atlantic’s development expertise in Nova Scotia complements our exploration success in Bulgaria. Our corporate strategies are aligned, with Velocity’s development objectives mirroring Atlantic’s successful hub-and-spoke approach of satellite deposits feeding a centralized processing plant. The proceeds from the financing will allow for the progression of our PEA-stage Rozino gold project toward feasibility and for exploration and resource definition of several additional projects. We believe that 2019 will be a transformative year for Velocity.”

$9 Million in Proceeds Will Go a Long Way….

Upon deployment of the C$9 million, Atlantic Gold will own 39.2% of Velocity Minerals on a partially diluted basis. Atlantic Gold and Velocity plan to work closely together to advance Velocity’s Rozino project through Feasibility studies and ultimately, if warranted, construction and commissioning.

Proceeds from the Strategic Investment will be used to fund the advancement of the Rozino gold project towards Feasibility and permitting, including resource expansion and definition drilling, engineering studies, and environmental monitoring and assessment. In addition, Velocity will proceed with exploration and assessment of satellite deposits where Velocity has negotiated option rights.

From the press release,

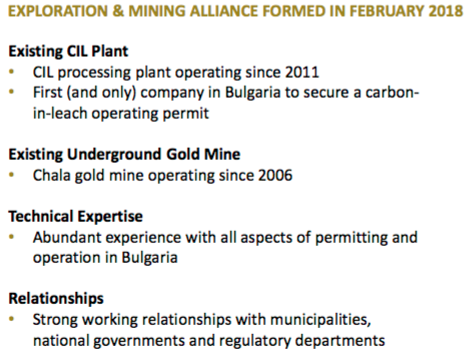

“Velocity envisions staged open pit mining of satellite deposits and processing in a central CIL plant. An existing, operating processing plant is available through an Exploration and Mining Alliance with its established Bulgarian operating partner. Velocity’s strategy is to build a production profile of more than 100,000 ounces of gold per year for over 10 years.”

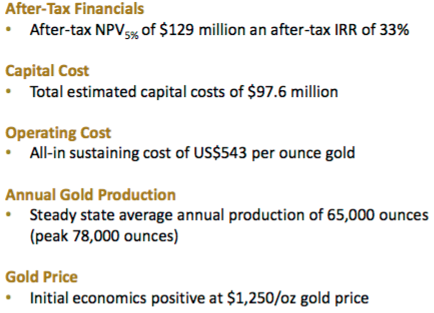

Atlantic Gold was drawn to Velocity’s Rozino project due to the attractive features of its PEA.

PEA Based on Just a Six-Year Mine Life

- AISC in the range of ~USD$550-650/oz, in the lower decile of industry costs

- Low initial capex

- Low strip ratio deposits with a 1.51 g/t Life of Mine (LOM) gold grade

- Significant Resource extension potential at existing deposits

- Simple metallurgy and conventional processing methods

- Potential for multiple open pits that could be treated through a central milling facility

- An under-explored gold belt, with little, if any modern gold exploration

Velocity has an additional important attribute, a local partner that it has an agreement with to process mineralized material through the partner’s currently operating CIL process facility. The facility is located near the Rozino deposit.

The Rozino project is arguably more robust than the PEA implies. It has an after-tax NPV(5%) of C$129 million and after-tax IRR of 33%, which is fairly compelling for a company with a market cap of C$14 million (pre-Altlantic Gold investment). But what makes it really interesting is the mine life. The considerable NPV of C$129 million is on just a six-year mine life.

Ample Opportunities to Extend Mine Life at Rozino

With Atlantic Gold’s investment and strategic advice, along with funded exploration drilling, that mine life could possibly be doubled. Or, it could result in more production per year. I won’t try to estimate what that might mean for the NPV and IRR, but it would be significant. Higher production levels, if modeled in the next Feasibility report, could potentially lower already low all-in sustainable costs.

This move by Atlantic Gold is a tremendous vote of confidence in Velocity, the Rozino project and the team. It’s also a vote of confidence in Bulgaria. At a time where funding junior miners is extremely difficult, Atlantic could have chosen to fund dozens of projects, dozens of management teams. But, they chose Velocity Minerals. And, in looking at Atlantic Gold’s press releases over the past year, I don’t see any strategic investments into other juniors.

With a C$400 million market cap and C$40 million in cash, and Atlantic Gold’s operations exceeding targets, this is a company that has the staying power to see Velocity not just through Pre-Feasibility this year, but well beyond that. In my opinion the chances that Rozino becomes a mine, surrounded by satellite deposits that could possibly extend mine life beyond six years, has gone way up. To reiterate, this is a huge vote of confidence and a substantial de-risking event.

Will the market recognize this de-risking? Time will tell. But, C$9 million will take Velocity Minerals a long way toward potentially creating substantial shareholder value. This cash injection frees management from the arduous task of raising capital, allowing the team to focus on what they best—exploring and developing gold mines.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Epstein Report Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Velocity Minerals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Velocity Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock options in Velocity Minerals and it was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic. [ER] may buy or sell shares in Velocity Minerals and other advertising companies at any time.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Velocity Minerals, a company mentioned in this article.

Charts and graphics provided by author.

( Companies Mentioned: VLC:TSX.V; VLCJF:OTCQB,

)