Canopy Rivers (RIV:TSXv; CNPOF:OTC) is the marijuana stock that has what billions of dollars of institutional money are desperately searching for…

That is – RAPIDLY GROWING FREE CASH FLOW!!!

Predictable and growing cash flow is what the institutions want. They have been searching for marijuana stocks with real business fundamentals and traditional valuations.

By mid-2019, I think that every institution that wants to deploy capital into the marijuana sector will own Canopy Rivers.

Today this business is already generating a good and growing amount of free cash flow. I’ll explain:

Think of Canopy Rivers as the private merchant bank of Canopy Growth (WEED-TSX) and its CEO Bruce Linton – but they’re allowing YOU to buy into their best-in-class deal flow.

With $5 billion cash, you can bet Canopy Growth sees a lot of companies they want to buy – all over the world. But some entrepreneurs don’t want to sell outright – and that’s where Canopy Rivers comes in. Seeded by Canopy Growth, its management team and insiders, Canopy Rivers funds the best deal flow that Canopy Growth can’t buy.

I think it’s a great business model – they create a small-cap merchant bank and fund it enough so they can do several deals at once – any one of which can – and have – created multi-baggers big enough to show up in the Net Asset Value (NAV) of “Rivers”. And they do no business in the US.

Canopy Growth has a controlling voting interest in Rivers’ stock, to make sure nobody can steal the company. But they’ve set it up perfectly – there is almost no G&A in Rivers; everybody owns so much stock they don’t need the money.

Rivers already has 12 investments – and they use debt, convertible debt, pref shares, regular equity and royalties in their model – in mostly private but some public companies.

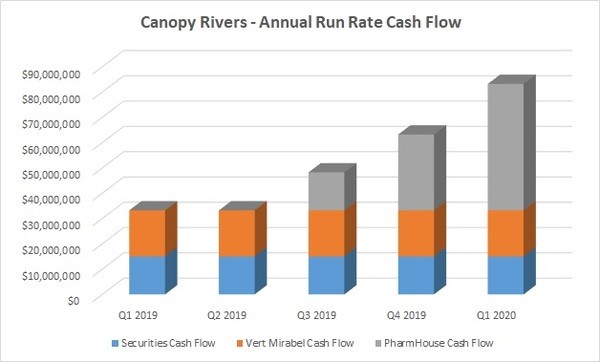

Think about this – just the investment income from their portfolio will be $15 million annualized at YE 2019, vs. cash G&A of just $7 million. Then of course, as their investments grow and mature, the cash flow net to them should increase – and by a lot. Here’s what my research shows annualized cash flow COULD look like in the coming 5 quarters:

That is not well understood by the market because quarterly financial filings come out months after cash flow is actually generated… so the institutions haven’t picked up on the story. Canopy Rivers just IPO’d late Q3 18 and is just starting to filter into stock screens.

By my calculations Canopy Rivers could see cash flow increase 6 to 10 times over the course of 2019. As that happens, more institutions will be comfortable enough to own the stock.

That is why Canopy Rivers isn’t a marijuana stock that I own… it is why it is the only marijuana stock that I own! It’s a (merchant) bank. Banks make money. Banks with debt that can convert into lucrative equity in select companies. That’s what I mean by low-risk/high-reward.

Everyone knows that 2019 will be a huge year for the marijuana business. Momentum is growing in

Canada and internationally. The problem is that the institutions have no clear way to play it – the typical marijuana stock is all story and no substance.

Canopy Rivers is different. This is a business built on quality from top to bottom. This is a company that everyone can own… and everyone interested in the marijuana sector eventually will own.

It ticks every box on my investment checklist:

1. Top notch management – CEO Bruce Linton and his team recognized as the BEST in the industry

2. Management is hugely incentivized by equity ownership not big salaries (Linton is paid just $1/yr!)

3. No debt and a huge cash balance – great balance sheet ($40 million net cash)

4. Cash flow positive and growing fast – which could be up 6 to 10 times in 2019

5. Has a low valuation relative to its growth rate (I’ll get to the specifics on that in a moment)

This company is the ONE marijuana stock that gives investors everything they could ask for – including a realistic valuation!

What Canopy Rivers Has In Store For 2019

Cash Flow, Cash Flow and More Cash Flow!

There is a lot to the Canopy Rivers Story, but I’m going to focus in on what I believe to be the main driver of growing cash flows – a joint venture called PharmHouse.

PharmHouse combines the marijuana expertise of Canopy Rivers and a large, seasoned North American greenhouse operator. The greenhouse partner is one of the world’s leading commercial agriculture and produce companies.

This partnership will be huge – it already has a long growth runway.

PharmHouse is retrofitting a massive, 1.3 million square foot greenhouse for cannabis production in Canada…and there are already plans to build another one of comparable size.

And then another, and another and another….

This is a brand-new, top-of-the-line production facility built by North America’s top greenhouse operator. Comparing this to other, older facilities that many peers are using to grow marijuana – this is like comparing an iPhone with a 1980s mobile phone that was the size of an encyclopedia.

Production from this facility should be very profitable. The anticipated selling price in 2019 will be $3.75 per gram, and management has been rightly basing all decisions on profit margins of just $1 per gram – and even that shows PharmHouse’s first facility generating $100 million of annualized free cash flow by the end of 2019.

Half of that production belongs to Canopy Rivers – which equals a run-rate of $50 million in cash flow from just this one asset by Year End 2019.

And PharmHouse is just one asset out of the 12 that Canopy Rivers has to offer!

This Is The Lowest Risk Lottery Ticket

You Will Ever Find In Marijuana

After PharmHouse, Canopy Rivers has 11 other marijuana projects underway. That means that Canopy Rivers’ shares come with free huge upside optionality… multi-bagger potential, lottery ticket winning type returns.

Canopy Rivers is an incredibly advantaged merchant bank. As a publicly traded sub of Canopy Growth, “Rivers” gets best-in-the-world-deal-flow… Canopy Rivers gets to put seed capital into the best marijuana start-up companies at incredibly favorable terms.

It’s like being in Silicon Valley and getting acccess to the seed financing of the Facebooks and Googles of the tech world.

Canopy Rivers can see huge increases in its share price as its investments go from millions to tens of millions or hundreds of millions of dollars… those returns would be lost on the balance sheet of the $12 b-b-b-illion market cap of Canopy Growth – which is why the deals are pushed to Canopy Rivers.

At least, that’s the way it’s supposed to work. It makes sense to me.

Canopy Growth CEO Bruce Linton is the acting CEO/Chairman here, working for $1/yr and a whack of stock.

That means that you have…

1. The best and most experienced management team in the marijuana world

2. Giving “Rivers” the best deal flow they come across

3. And they’re completely aligned with shareholders

Like I said, they already have a minimum $8 million in investment income for 2019 and easy-to-achieve milestones that pushes it to over $15 million – against cash G&A cost for the business of just over $7 million per year. All 35 employees at Canopy Growth also have equity linked exposure which incentivizes them to push top investment opportunities to Canopy Rivers.

In 2019, Year One of this business model, I’m really invested in Canopy Rivers because of the cash flow growth that PharmHouse could/should crank out by year end… it could be as much as $50 million net cash flow to Canopy Rivers by year-end and growing from there.

In a perfect world, Rivers is at an $84 million run rate this time next year – against an Enterprise Value today of some $520 million–about 6x EBITDA.

Like every other management team in a public company, they must execute flawlessly for that valuation to make sense. But it’s certainly one the institutions could understand – and buy.

DISCLOSURE: I am long Canopy Rivers.

Keith Schaefer

Copyright © 2011

This feed is for personal, non-commercial use only.

The use of this feed on other websites breaches copyright unless you have written permission from Keith Schaefer of Oil and Gas bulletin to republish. If this content is not in your news reader, it makes the page you are viewing an infringement of the copyright. (Digital Fingerprint:

3r5723475234957asdgvaisduthadsfg)