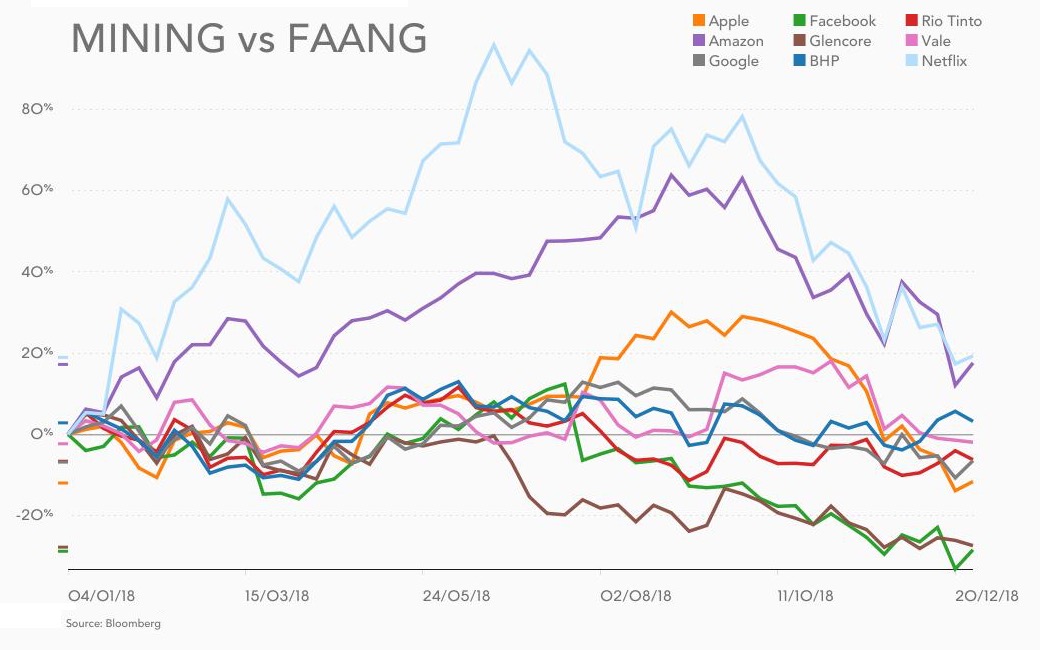

After a strong start to 2018, the value of the world’s largest mining stocks began turning down well before summer as worries about a China–US trade war continued to mount.

Even before the Trump–Xi tariff battles began, fears of a slowdown in China, consumer and producer of nearly half the world’s metals and minerals, were gnawing at investors hoping for another year of strong gains for the industry.

And going into 2019 with regulatory crackdowns likely and growing consumer privacy concerns the FAANGs may well have a tougher year ahead than the mining majors

Further confirmation of a weakening Chinese economy came on Thursday after data showed monthly earnings at the country’s vast industrial sector dropped for the first time in nearly three years.

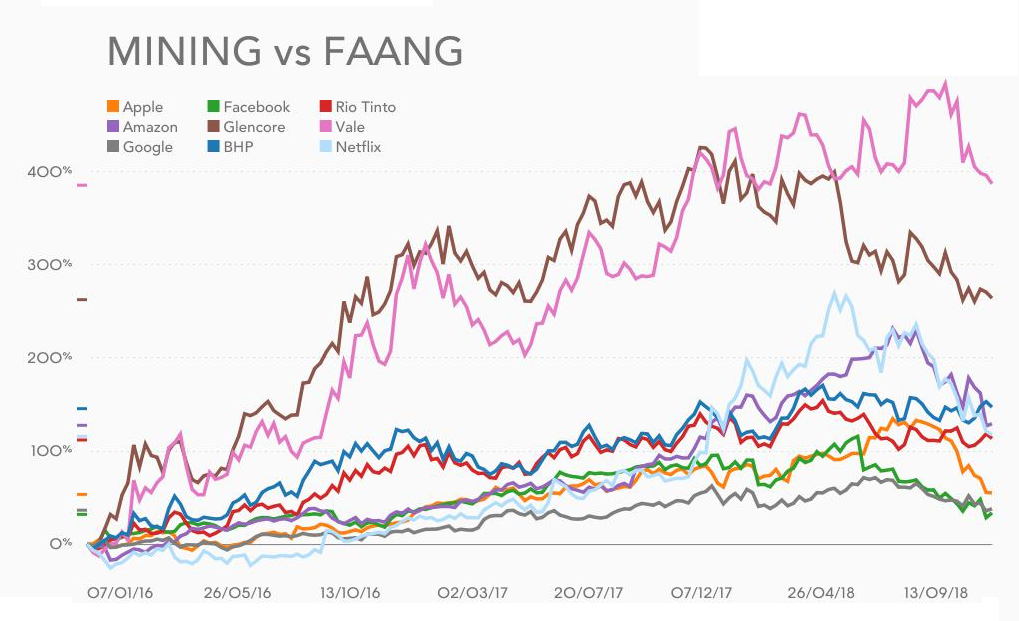

Mining investors can at least console themselves by the fact that measured from the beginning of 2016 – the bottom of the cycle – money put into the sector’s heavyweights are still outperforming US tech industry titans.

With the exception of Rio Tinto (still worth more than double it was January 2016), mining’s largest firms have vastly outperformed Apple, Amazon, Facebook, Netflix and Google shares over the past three years. And in 2018 world number one mining firm BHP – worth US$110 billion – again bested the world’s most popular search engine, social media network and mobile phone maker.

And going into 2019 with regulatory crackdowns likely and growing consumer privacy concerns the so-called FAANGs may well have a tougher year ahead than the mining majors.

The post BHP, Rio, Vale stock bested Apple, Google, Facebook in 2018 appeared first on MINING.com.