This post And the Winner Is… Real Estate appeared first on Daily Reckoning.

We are a little over one year since President Donald Trump signed the Tax Cuts and Jobs Act (TCJA), and since then, real estate investors have been rushing to make sense of it all. In what represents the most sweeping U.S. tax reform since the Tax Reform Act of 1986, many of the changes are set to have a significant impact on businesses and individuals alike.

The new 20% deduction that’s available on pass-through income for sole proprietors and LLCs, or the higher 100% bonus depreciation allowance on the purchase of business assets are both new for the 2018 tax year. Despite the fact that this act contains some complicated areas, the good news is that generally speaking, business will most likely benefit from it—and that includes many real estate investors.

Keep in mind that currently, many of these changes are temporary, but this past September, as part of a three-pronged legislative package dubbed “Tax Reform 2.0,” Republicans approved two other bills. One would make tax rules governing retirement and education savings more flexible, while the other would provide bigger tax breaks to start-up companies.

While it may not be wise to restructure all of your investments solely for the purpose of tax breaks, it’s certainly a good idea to pay attention to the changes and consult with a CPA to find out how you can benefit most.

Income Tax Rate Reductions

Most taxpayers will be celebrating this year when they file their tax returns this year.

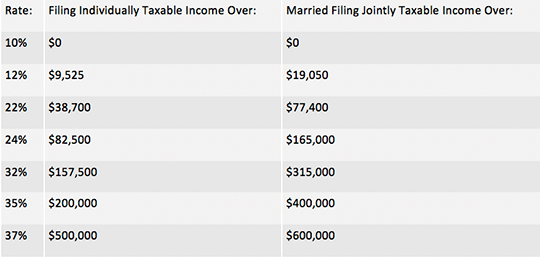

While the income brackets themselves remain the same, most of the tax rates are slightly lower. Prior to the changes, the tax brackets were 10%, 15%, 25%, 28%, 33%, 35% and 39.6%. The new tax rate breakdown is as follows:

Pass-Through Deduction

Real estate investors will see a new 20% deduction on pass-through income form business other than C-corporations. This will have a significant impact on investors. This includes sole proprietors, LLCs and S-corporations. With these entities, the company itself doesn’t pay taxes. Instead, it’s passed through to the owner. For landlords and property investors, who often structure their investments as LLCs, this provision could represent significant savings.

If you’re married, filing jointly with over $315,000 in AGI, or filing single with over $157,500 make sure you consult a tax professional as there may be limitations to claiming the full 20% deduction.

Another change is the lower limits to mortgage interest deductions. Under the new law, mortgage interest is now only deductible on the first $750,000 on primary and secondary residences, although there is a grandfather clause that allows interest on previously purchased residences to be deducted up to $1 million. Also, interest on home equity loans is now only able to be deducted if the money was used for home improvements.

Additionally, state and local tax deductions, while unlimited before, are now capped at $10,000. Of course, investors and residents in states with high income taxes will feel this change the most.

Finally, for businesses with gross receipts of over $25 million, the net interest expense deduction will also now be limited to 30% of earnings before interest, taxes, depreciation and amortization.

100% Bonus Depreciation

Business owners have been able to deduct the cost of assets that they purchased for the business—up to 20%—with the TJCA, the amount has been increased to 100% in one year.

For example, let’s say this year, you buy a new $60,000 heavy SUV and use it 100% in your business. You can deduct the entire $60,000 in 2018 thanks to the new 100% first-year bonus depreciation break. If you only use the vehicle 60% for business, your first-year bonus depreciation deduction is $36,000 (60% x $60,000)

If you instead buy a used $45,000 heavy SUV, pickup, or van, you can still deduct the entire cost in 2018 thanks to the 100% first-year bonus depreciation break — which is allowed for both new and used vehicles. If you only use the vehicle 60% for business, your first-year bonus depreciation deduction is $27,000 (60% x $45,000).

REITS

Real Estate Investment Trusts (REITs) are treated quite favorably under the TCJA. Important changes that affect REITs specifically are:

-

- Ordinary REIT dividends (i.e., dividends that are not declared as capital gain dividends or qualified dividend income) are entitled to the 20% pass-through deduction discussed above. However, these REIT dividends are not subject to the wage/capital limitation.

-

- REITs, as corporate taxpayers, are subject to tax at corporate rates on any income they do not distribute in a tax year to their shareholders. Accordingly, REITs that do not distribute 100% of their taxable income in any year will be taxed as the new lower corporate tax rate of 21% on any undistributed income.

Real Estate as a Tax Shelter

A serious real estate investor should never have to pay tax on their cash flow or on the gain from the sale of their real estate. Plus, understand that rental real estate investments not only shelter cash flow from the real estate but can also shelter other income from taxes. With proper planning, rental real estate can create huge tax deductions for your business and salary income.

The key to building tax-free wealth in real estate is to continue buying more and more real estate and rolling your gains into like-kind properties through tax-free exchanges.

There’s a whole strategy around using exchanges and depreciation to pay no taxes, but I’ll leave that to the tax professionals like my Rich Dad Advisor, Tom Wheelwright, to explain.

While the long-term implications of this bill are yet to be seen, for now, many of the changes seem poised to directly benefit professional real estate investors — especially those who buy property under LLCs.

If you don’t yet have a business or aren’t investing, then it’s high time to start. Work with a knowledgeable tax advisor to build a strategy around deductions and tax law, to ensure you have getting every benefit you are entitled to.

Regards,

Robert Kiyosaki

Editor, Rich Dad Poor Dad Daily

The post And the Winner Is… Real Estate appeared first on Daily Reckoning.