Source: The Critical Investor for Streetwise Reports 12/20/2018

The Critical Investor presents an analysis of Trilogy Metals by Kees Dekker, a mining investment consultant.

1. Critical Investor Introduction

This time Kees Dekker analyzed Trilogy Metals Inc. (TMQ:NYSE.MKT; TMQ:TSX), which sports one of the highest grade copper projects worldwide (Arctic). I found Kees’ report interesting enough to obtain company feedback, and after a lengthy process of six weeks here is the summary of the end product for your convenience. Kees found several reasons to increase opex meaningfully compared to the PFS, so as a consequence the post-tax NPV8 came down significantly (from US$1412.7 million to US$803.8 million @US$3.00/lb Cu), and I estimated the adjusted IRR at 23% (from 33.4%), which are still strong numbers. At a current market cap of US$226 million one could argue that Trilogy is undervalued, as Bornite hasn’t been taken into consideration yet.

However, Trilogy is using an open pit scenario for Arctic with a high strip ratio because of the poor rock competence, otherwise I believe an underground scenario would have been more profitable for Arctic. As Bornite is very close to Arctic, about 30km away, chances are that the underground resource of Bornite represents similar issues, and the open pit component of Bornite is most likely too low grade to be economic at the moment, as the operating cost of Arctic already outscores estimated Bornite revenues per tonne for both the PFS and Kees’ own estimates. The strip ratio for Bornite most likely seems to be lower than Arctic, but not so much for resulting operating cost to be significantly lower than revenues. Therefore I am not inclined to add much value for Bornite, as it is just a leveraged play that needs a higher copper price in my view to be economic. I found the LNG discussion between Kees and Trilogy management very interesting; it seems Arctic is dependent on LNG but hasn’t secured access to it yet.

All in all, taking into account the very Nordic location for Arctic, PFS stage and several question marks, I believe Trilogy is fair valued at the moment. See for yourself in the following summary by Kees Dekker, and the full version can be found on www.criticalinvestor.eu, so you can make up your own mind about this company. – The Critical Investor

All presented charts are provided by Kees Dekker, unless stated otherwise.

All pictures are company material, unless stated otherwise.

Trilogy Metals: A Very Good Investment Opportunity for the Medium Term

2. Introduction

Trilogy Metals Inc. (NYSE:TMO) (TSX:TMQ) is a Canadian gold mining company that started off on 27 April 2011 as NovaCopper Inc., a wholly owned subsidiary of NovaGold. The NovaGold security holders approved on 28 March 2012 a spin-out involving NovaCopper shares being distributed to NovaGold shareholders as a return of capital. The shares were then listed on the Toronto Stock Exchange (TSX) and New York Stock Exchange (NYSE) on 25 April 2012.

At the time of the spin-out NovaCopper owned the Ambler project in Northwest Alaska and the rights to the adjacent property, referred to as Bornite Lands, through an exploration and option agreement with an Alaska Native Corporation, Nana Regional Corporation Inc. (NANA). The Ambler project had been purchased by NovaGold in December 2009 from two Kennecott subsidiaries in 2009 for US$24 million in cash and US$5 million in NovaGold shares. The two properties, Arctic and Bornite, combined were from then on referred to as the Upper Kobuk Mineral Projects (UKMP).

In February 2012, before the listing, a preliminary economic assessment (PEA) had been completed on the Arctic deposit within the Ambler project area based on 30.8 million tonnes (Mt) of Indicated and Inferred Resources with very high grades of copper (approx. 4.5%) and good grades of zinc (approx. 5%), plus gold, silver and lead credits. The study, which assumed underground mining, arrived at a net present value at a discount rate of 8% (NPV8) of US$533 million and an internal rate of return (IRR) of 26%.

One year later a PEA study was completed assuming open pit mining and an expanded throughput rate, halving the life of mine (LOM) from 25 years to 12 years. This did not improve the economics compared to the previous PEA: an NPV8 of US$537 million and 17.9% IRR. In addition, discussions were entered into with the Alaskan authorities towards advancing the Amble Mining District Industrial Access Road (AMDIAR) to give better access to the UKMP projects.

Progress in advancing AMDIAR has been very slow with the Environmental Impact Study (EIS) only authorized by Alaska’s Governor in October 2015 and a project kick-off meeting held in early December 2016 (more than one year later!). The latest news is more promising with the draft EIS now scheduled for release for public comment by the end of March 2019.

Between 2012 and 2017 the Arctic project advanced slowly, probably because of the low prevailing base metal prices. Records show the company consistently spending below the guidance for the year, carefully managing its cash resources until April 2017 when it entered into an option agreement with South32 Ltd., a large diversified base metal company. The option was for a 50/50 joint venture with respect to Trilogy’s UKMP assets and the Exploration and Option to Lease Agreement with NANA Regional Corporation, Inc. To keep the option agreement valid South32 must contribute a minimum of US$10 million each year, for a maximum of three years. During these years South32 may exercise its option at any time to form the 50/50 joint venture. To subscribe for 50% of the JV, South32 will contribute a minimum of $150 million, plus any amounts Trilogy spends at the Arctic Project over the next three years to a maximum of US$5 million per year, less an amount of the Initial Funding (the US$10 million annual funding) contributed by South32.

Since South32’s involvement, and with much better market conditions, the UKMP projects advanced much more rapidly.

In mid-December 2017, with a major shareholder wishing to dispose of its shares, South32 acquired approx. 6.5 million shares (6% of the outstanding shares) and Rick Van Nieuwenhuyse, Trilogy’s CEO, increasing his shareholdings by approx. 1.7 million shares to 2.8 million shares, or approximately 2.6%.

The above paragraph can be seen as a great endorsement of South32 (and the CEO in his personal capacity) of the prospects for the UKMP assets.

On 20 February 2018 the company announced the results of the PFS for the Arctic project, assumed to be developed as an open pit operation, with an after-tax NPV8 of US$1,413 million and IRR of 33.4%. This report was filed on the Sedar website and constitutes the basis for the valuation of the Arctic project in this report.

In July 2018 another resource estimation for Bornite added almost 35,000 tonnes of contained cobalt at an average grade of 0.019% to the 2.9 million tonnes contained copper resources at an average grade of 1.74% Cu, defined in 2016.

Figure 2_1 shows the share price performance of Trilogy since April 2012 on the Toronto stock exchange compared to the copper price over that period.

It is not clear what caused the sharp drop in share price immediately following listing, but this could be related to large NovaGold shareholders disposing of the share as the base metal nature may not have been in line with a precious metal focused investment strategy. Since then the share price has roughly followed the fortunes of the copper price until the beginning of 2018 when it started to rise despite a sharp drop in the copper price. On 14 December 2018 the price dropped 12% following disappointing infill drill results for Bornite.

3. Historical Performance

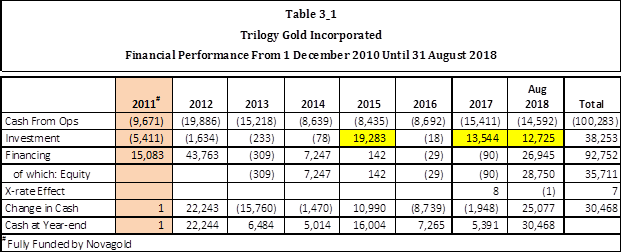

Table 3_1 gives the historical financial performance from 1 December 2010 (financial year-ends are on 30 November) until 31 August 2018 for Trilogy.

Table 3_1 shows that:

- Trilogy almost fully expensed its exploration work.

- Outlays were high until 2013 with the numbers in the 2011 financial year reflecting activities funded by NovaGold’s. In 2012 the financing was fully provided by NovaGold.

- After 30 November 2013 Trilogy’s management reduced its annual expenses to a remarkable constant ± US$8.6 million, only to increase expenditure with improving metal prices and the involvement of South32.

- The remarkable feature of historical financial performance is that it required very little shareholder support by first drawing down the cash balance and then acquiring cash through an all paper transaction in 2015 (see yellow highlighted cell), followed by South32 funding, which is accounted for under “Investment.”

- Given the US$24 million acquisition in 2009 by NovaGold and the total spent of US$100.3 million since November 2010 total investments in the projects are probably approximately US$125 million.

The table above illustrates that management hardly called upon its shareholders for funding. It has spent US$100 million and needed to tap shareholders for only US$36 million, most of which occurred in 2018 for US$28.8 million. One of the reasons for this is management being very modest with their own remuneration. In the nine months to 31 August 2018 they spent US$2.9 million on salaries, general and administrative expenses and investor relations. In addition US$0.4 million were spent on professional fees on an annualized basis. Stock-based compensation was more generous at US$1.3 million. One can conclude that money spent is really for advancing projects, slowly in the years before South32’s involvement, much more rapidly since.

The following section will look into what past expenditure has achieved for the current shareholders in terms of project value.

4. Valuation of the Arctic Project

4.1 Mineral Resources

The technical information, illustrations and wording in Section 4.1 and Section 4.2 of this report have been drawn from a NI 43-101 compliant technical report in support of the PFS, dated 6 April 2018 by Ausenco Engineering Canada Inc. unless specifically stated otherwise.

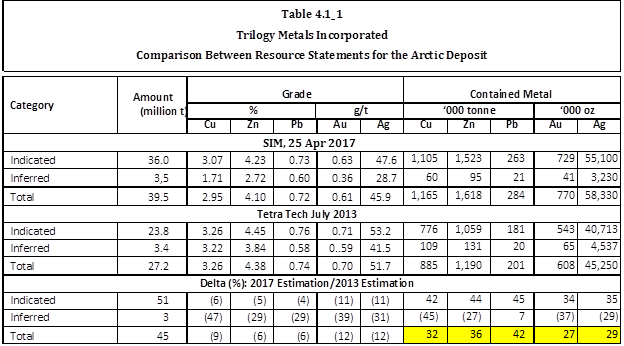

The PFS is based on mineral resources amounting to 39.5 million tonnes, which is 45% more than the resources in 2013 (see Table 4.1_1 for the comparison).

The 2017 resource estimate is based on only 17 additional in-fill holes compared to the 135 holes used for the 2013 resources. The large increase in resources can to a minor extent be explained by the lower grade because of a lower cut-off grade resulting more favorable input parameters. According to Trilogy management, the increase in total resources is explained by much wider than previously interpreted widths of the massive sulphide intersected by the infill holes and different geological interpretations that have added previously excluded material.

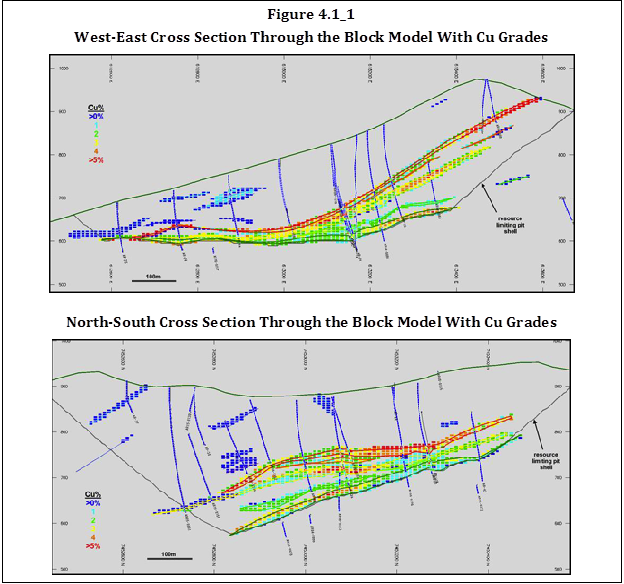

Figure 4.1_1 contains two cross sections through the copper grade block models, which have been extracted from pages 14-32 and 14-33 of the Ausenco technical report, to illustrate the shape and extent of the Arctic deposit.

4.2 Mineral Reserves

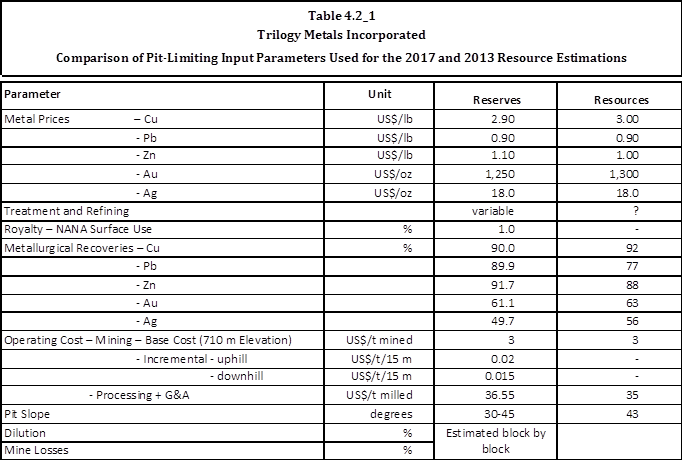

The pit optimization parameters for the reserve pit shell are based on slightly more conservative values than for the resource pit shell as shown in Table 4.2_1.

For the reserves estimation dilution was applied to the undiluted resources in two steps:

- Planned dilution, including waste that is included in the 5 m x 5 m x 2.5 m smallest mining unit (SMU). The small size SMU assumes mining equipment that can be highly selective in what is broken and loaded.

- Contact dilution: assumes that the grade of a given SMU block will be diluted “by 20% of tonnage from each of the four adjacent blocks.” This does not make much sense as stated because it implies that the particular SMU would have 80% material from adjacent blocks. If an adjacent block is classified as Inferred Mineral Resource, its grade is considered to be zero. If the adjacent block is classified as Indicated, but below cut-off, dilution is taken at the grade of the adjacent block.

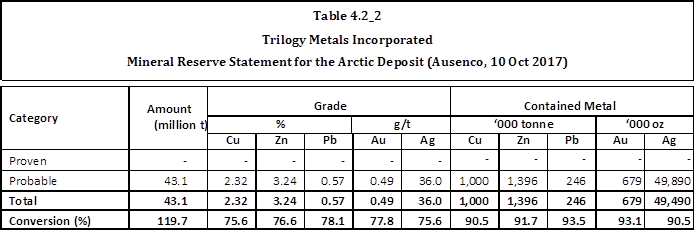

Table 4.2_2 gives the mineral reserve statement as declared by Ausenco.

The table shows that Indicated resources have been diluted by between 22% and 25%. The explanation for the reserve tonnage being less than an extra 20%, instead of increased by the dilution rate is due to mine losses incurred.

4.3 Economic Valuation – Arctic Project

4.3.1 Introduction

For this valuation the input parameters as suggested by the PFS have been modelled, also to verify that the taxes have been modelled accurately. Thereafter input parameters have been amended, or flexed to determine their impact on the cash flow.

4.3.2 Metal Prices and Marketing Terms Assumed

This valuation has modelled For the Base Case of this valuation, the spot prices on 14 December 2018, US$1,239/oz Au, US$14.55/oz Ag, US$2.78/lb Cu and US$1.18/lb Zn and US$0.99/lb Pb and an exchange rate of C$1.338 per US dollar were used to determine the value of the discounted cash flow.

Based on the marketing terms assumed by Ausenco for the various concentrates this valuation shows that the copper concentrate accounts for more than 63% of total revenue and copper metal is responsible for slightly more than 60%. Zinc adds another 21% to revenue. The Arctic project is therefore dominantly a copper-zinc project. The contribution of lead is negligible, but recovery of the metal is necessary to clean the copper concentrate and to capture the precious metals as by-products. The precious metal content is the reason for the lead concentrate being the highest value product. The high off-mine costs for zinc result in only 51.9% of the value of the metal produced being paid for.

Using the metallurgical recoveries, concentrate grades and metal prices assumed in this valuation, results in a 6% drop in at-mine revenue of US$438 million, of which US$260 million is accounted for by using the metallurgical performance suggested in the text of the PFS report and not the unsubstantiated improved PFS cash flow model assumptions.

4.3.3 Production Schedule

This valuation has adopted the production schedule in the feasibility study, which includes a three-year pre-production period, a first year of production at 85% of steady state plant throughput of 3.65 million tonnes per annum (Mtpa), followed by ten-year steady state production and treatment of the remaining reserves in year 12.

The PFS cash flow model calculates the financial performance as if the go-ahead decision has been made. This valuation assumes that the three-year preproduction starts on 1 January 2020 with first construction activities during the year. This may be too optimistic and an additional 1-2 years required for studies and permitting.

4.3.4 Operating and Capital Expenditure

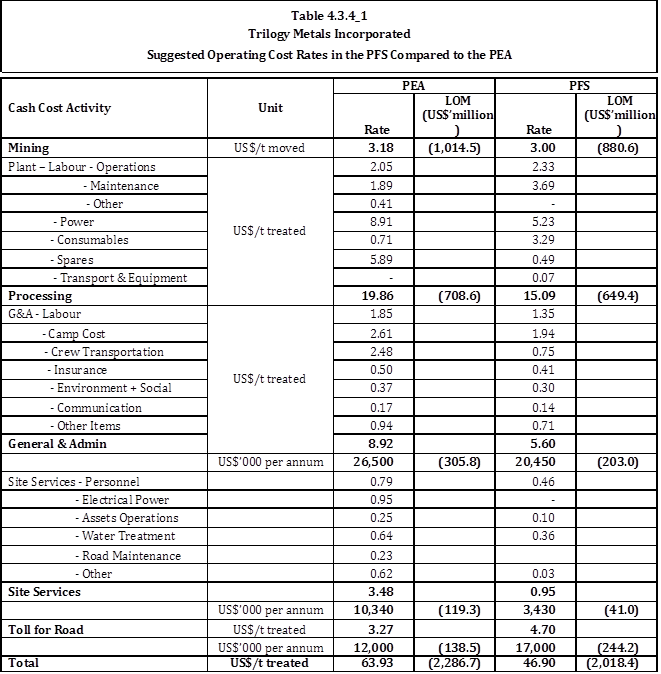

Table 4.3.4_1 shows the cost structure suggested in the PFS study compared to the 2013 PEA study, giving the same breakdown as used in the PEA.

The cost provisions have all been reduced from the PEA, partially by assuming that certain consumables (e.g., liquefied natural gas instead of diesel) are available, lower consumable and spares costs, or lower staffing levels.

The much lower processing cost is purely because of much lower power and consumables/spares provisions. The lower power cost is due to much lower electrical power unit cost generated on site of US$0.173/kWh generated with liquefied natural gas (LNG), compared to US$0.322/kWh in the PEA, generated with diesel. According to the PFS the LNG will be supplied “via existing fuel supply networks near Port Mackenzie, Alaska.”

The phrasing is somewhat misleading as Trilogy actually assumes the implementation of the massive (US$43 billion) Alaska LNG Project (however, production planned for overseas exports), alternatively the completion of expansion of the LNG facility at Fairbanks, which if approved, financed and constructed would have more production by 2020. At the time of the PFS publication date the Pentex Alaska Natural Gas Company (Pentex) was owned by the Alaska Industrial Development and Export Authority (AIDEA); the same agency is responsible for the access road construction, and which was according to Trilogy “eager to finance expansion of the plant.” Pentex was however sold in June 2018 to the Internal Gas Utility (IGU), which is a public corporation that has as its mission “to provide low cost, clean burning, natural gas to the largest number of customers in the Fairbanks North Star Borough (FNSB) as possible, as soon as possible.” With that AIDEA has lost much control over promoting the project.

Access to the Arctic Project is proposed to be via a road, referred to as Ambler Mining District Industrial Access Project (AMDIAP) approximately 340 km long, extending west from the Dalton Highway where it would connect with the proposed Arctic Project area. The plan is for AIDEA, a state-owned private company, to raise the finances and construct the road and recover its investment through a toll levy. The PEA study assumed that the toll would be based on a US$150 million 30-year bond at 5% interest rate, with the Arctic Project paying US$9.7 million each year for its 12-year LOM. In the PFS this has increased to US$300 million and a 6% and 15-year. Yet, the toll was assumed still US$9.7 million annually for 12 years. No explanation is given why the annual toll has not increased. The PFS has, however, also included a road maintenance fee of US$2/tonne treated.

When benchmarking the suggested operating costs against the open pit Red Dog mine in Alaska, the unit costs compare very low, less so the mining cost. An NI 43-101 technical report by Teck dated 21 February 2017 gives mining cost of US$3.00/t mined for waste and US$3.15/t for ore with milling costs of US$29.11/t, Indirect cost (defined as overhead for mining and milling, camp and personnel transport costs) of US$7.011/t and G&A cost (defined as overheads for other service departments) of US$17.66/t. The mining unit rate of Teck therefore excludes technical services and supervisory costs, which seem to be assumed included in the Trilogy rate. Moreover, applying the rates for annual Indirect and G&A expenses to the current mill rate of 4.18 Mtpa, more than US$100 million is spent on these items alone each year.

Because of the unsatisfactory motivation for the various operating cost estimate reductions and the Red Dog cost structure, this valuation has added a 20% adjustment to increase the unit operating cost to US$55.73/t.

In addition, annual corporate overheads of US$5.6 million per annum were included.

4.3.5 Capital Expenditure

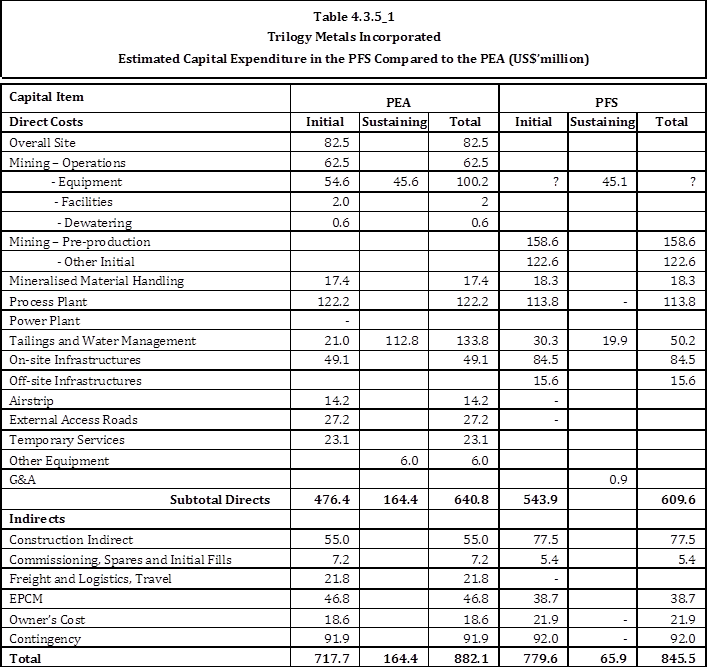

Table 4.3.5_1 shows the capital cost estimates suggested for the PFS compared to the provisions in the 2013 PEA study.

The information provided in the PFS is impossible to reconcile to the PEA values as they use different breakdowns.

The table shows a general decline in LOM capital expenditure with higher initial capital expenditure more than compensated for by lower sustaining capital expenditure. This is mainly due to very large savings on the tailings dam and a change in approach to waste handling, now assumed stored in a much cheaper, combined facility. There is nothing that stands out as very much underestimated, but it is difficult to determine what the total plant cost is including construction indirects, EPCM, etc. One would expect that the total plant in a difficult and isolated location such as Arctic with a monthly capacity of 3.65 Mtpa would cost more than US$210 million. Owner’s cost of slightly more than US$7 million per annum looks very low for a project such as Arctic.

This valuation has adopted the provisions and will investigate through sensitivity analysis the effect of higher capital expenditure.

A mine that produces concentrates needs to make substantial investments in working capital, with a long pipeline of concentrates shipped to the off-taker and being paid with a delay. This valuation comes to a peak investment of US$76.1 million, fully recovered at the end of the LOM, ignoring the risks of obsolesce, degradation and realization costs.

4.3.6 Royalties and Taxes

There are two royalties of 1% NSR applicable, one for the benefit of NANA and the other a retained interest by Falconbridge, now owned by Osisko Royalties. The latter is subject to a buy-out at any time of US$10 million. This valuation has assumed exercising the buy-out at the start of year 1. The PFS seems to ignore this outlay.

For the calculation of taxes reference was made to a 2012 slide presentation by PWC at the American School of Mines entitled “Basics of U.S. Mining Taxation” and a note by PWC with the title “Corporate Income Taxes, Mining Royalties and Other Mining Taxes; A Summary of Rates and Rules in Selected Countries,” dated June 2012.

Applicable taxes for mining companies in Alaska are:

- As from 1 January 2018 Federal Income Tax at 21.0%, which is a great reduction from the 35% applicable at the report date of the PEA.

- Alaskan State Tax another (AST) 9.4%.

- Alaskan Mining License Tax (AMLT) 7.0%

This valuation comes to a slightly higher tax amount that the PFS cash flow model. Obviously this valuation’s tax model introduces a slight negative bias into the results.

4.3.7 NANA’s Beneficial Interest

Whereas NANA may well elect to purchase a 25% interest by paying the 25% of monies invested minus US$40 million, it has been assumed here that they will elect for a 15% free carried net profit interest (NPI). According to the CEO of Trilogy, participation in net profits kicks-in after Trilogy/JV Company has earned a 9% return on its investments. The NPI is fully deductible for tax purposes. To avoid circular references in the cash flow model, this valuation has calculated the NPI on an after-tax basis, which should have little overall impact on the return to Trilogy/JV company.

4.3.8 Results

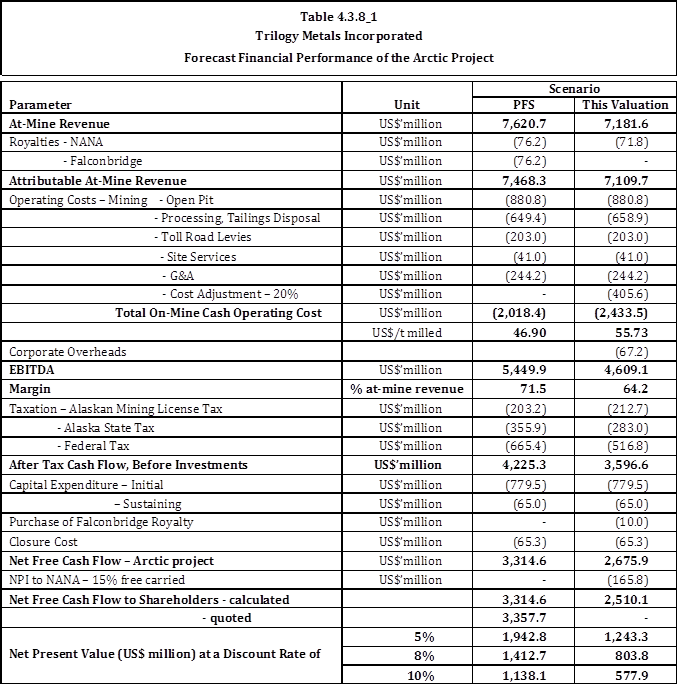

Table 4.3.8_1 compares the financial performance as per PFS with that for this valuation.

The net effect of the changes to the input parameters, being longer lead time, more plant feed, lower metallurgical recoveries and less favorable concentrate qualities, the buy-out of the Falconbridge royalty, 20% higher operating cost, the inclusion of investments in net current assets and more conservative tax calculation, is substantially lower cash flow for the Arctic project before having to give NANA its 15% share after earning a 9% return.

Under both scenarios the cash-operating margin is very high at between 64.2% and 71.5%. With an effective tax rate of 22%, much cash flows to the bottom line. The initial capital expenditure is less than 1.3 times annual at-mine revenue, which compares low to other mining projects. The pay-back period on an undiscounted basis is 2.8 years and the IRR is 18.1% assuming all funding to cover initial capital expenditure is arranged upfront and parked in risk-free financial instruments, which generate no real return.

The conclusion is that, at current metal prices, Arctic is a very robust project.

Sensitivity analysis shows that for every percentage point increase in copper and zinc prices the NPV8 increases by US$23.4 million (i.e., 2.9%) and for every percentage point increase in the LOM capital expenditure (i.e., US$8.5 million) the NPV8 drops by US$5.3 million (0.7%). The small negative effect of operating cost and capital expenditure increases relative to the Base Case values again demonstrate the robust nature of the project.

5. Review of the Bornite Project

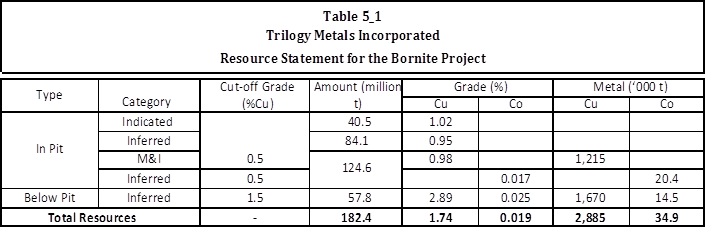

The latest resource estimation in an NI 43-101 compliant technical report, dated 20 July 2018, by BD Resource Consulting incorporated (BDRC) and Sim Geological Inc. (SIM) arrives at the numbers reproduced in Table 5_1.

The contained copper in the Bornite resource statement is approximately three times as large as the copper contained in Arctic reserves. Assuming the same 87% metallurgical recovery assumed for the floating cone used for the resource estimation and a concentrate of 30%, which reflects the bornite and chalcocite content at the copper price of US$2.78 on 14 December 2018 and the same marketing terms used for Arctic, total at-mine revenue of US$11.5 billion would be earned should all resources be mined. This excludes any by-product revenue from cobalt, silver and gold. In terms of revenue, this would make Bornite almost 60% larger than Arctic.

The at-mine value of a tonne of open pit resource is US$39 and of a tonne of underground resources it is US$115. These are values that in principle should give good cash margins indicating that Bornite is a valuable asset. It is not really possible to give a value for the project, but at a (conservative) cash margin of 40% it would generate US$4.6 billion to cover capital expenditure and taxes, exactly the same as this valuation calculates for Arctic.

As Bornite will be able to benefit of some of the infrastructure of Arctic (e.g., access road, some of the camp and buildings), capital intensity will be reduced.

In conclusion, the share price should reflect a considerable premium for the Bornite project over and above the value of Arctic underpinning value of Trilogy.

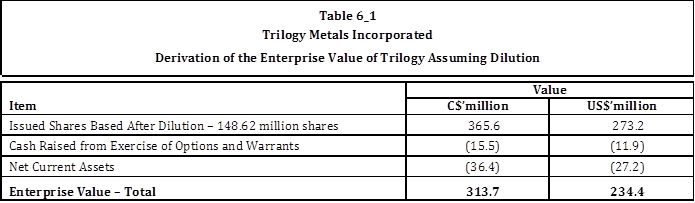

6. The Enterprise Value of Trilogy Metals at 14 December 2018

At the share price of C$2.46 on 14 December 2018 and with 131.53 million shares issued the market capitalization of Trilogy is C$323.6 million, or US$241.8 million.

At 31 August 2018 the company had 9.01 million options outstanding. The company unfortunately does not give exact details on exercise prices apart from weighted average prices for a number of options. All exercise brackets are at the current share price well in the money. Furthermore 1.55 million restricted and deferred share units were outstanding at 31 August 2018.

The company has 6.52 million warrants outstanding at an exercise price of C$1.52, therefore also in the money.

At 31 August 2018 the company had net current assets of US$15.5 million and no long-term loan.

Based on the above an Enterprise Value for Trilogy of C$313.7 million (US$234.4 million) is derived as shown in Table 6_1.

As the economics of the Arctic project are very robust, and Bornite shaping up as a very attractive bulk mineable deposit, it is highly unlikely that South32 will not exercise its option by April 2020. The JV company will receive US$150 million from South32 plus a maximum of US$5 million per annum Trilogy spends on the Arctic project minus South32 contributions of US$10 million per annum to advance Arctic and Bornite. Assuming that the option will only be exercised in April 2020, the JV company will receive US$135 million.

In other words, Trilogy’s intrinsic value is half of US$135 million plus the value of Arctic and Bornite. Based on this valuation Trilogy’s share in the option cash contribution and Arctic project are worth:

½ x (US$135 million + US$803 million) = US$469 million.

The value calculated above totally ignores any value for Bornite, which is substantial.

Conclusion: the market valuation of the UKMP projects is far below their intrinsic value, probably far below half. The probably reason for this is that development of any mine is still seen as years away.

* * *

This ends the summary of Trilogy Metals by Kees Dekker. If you have an interest in contacting Kees Dekker, this is possible through using the contact form on www.criticalinvestor.eu, which also hosts the full report as mentioned. Stay tuned for more analysis by Kees coming soon.

Bornite; exploration camp

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Kees Dekker is a freelance mining investment consultant, holding BSc, MSc (both Geochemistry), BCom and MBA degrees, and has more than 35 years of experience in the mining industry, ranging from geologist to mineral economist to management appointments. Since 2012 Dekker has been a freelance consultant involved in technical reviews of, among others, the Stillwater Mining Company operations and projects, Nevada Iron Limited, New Chris Minerals, and for private equity funds such as QKR, Casablanca Capital (Cliffs Natural Resources) and Blackstone Special Opportunity fund (Talvivaara mine in Finland and the Renard diamond project of Stornoway).

Disclaimer:

The author is not a registered investment advisor, and currently has no position in any of the companies mentioned in this article. Kees Dekker is also not a registered investment advisor, and currently has no position in any of the companies mentioned in this article. All facts are to be checked by the reader. For more information go to the websites of the mentioned companies and read the available company information and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Images and charts provided by the author.

( Companies Mentioned: TMQ:NYSE.MKT; TMQ:TSX,

)