If we want to know where Gold is going we should follow Gold. Right?

How about following gold stocks? At times, they lead Gold.

What about the US Dollar? Wrong!

In 2019, one market more than any other will impact Gold.

That is the stock market.

History argues (within the current context) that when the Federal Reserve ends its rate hikes, Gold’s downtrend will be over and when the Fed cuts rates, the bull market shall begin.

Fed policy is dictated by economic data and financial conditions which of course can be reflected by the stock market, which is also a reflection of corporate profits.

Extended weakness in the stock market should bring the Fed that much closer to rate cuts. However, if the stock market is able to mount a decent counter trend rally in 2019, it could raise the possibility of another hike. Right now, the market expects no hikes in 2019 and even half of a quarter point cut in 2020.

Other than the cyclical bull market of 1985 through 1987, Gold has never enjoyed a real bull market without outperforming the stock market.

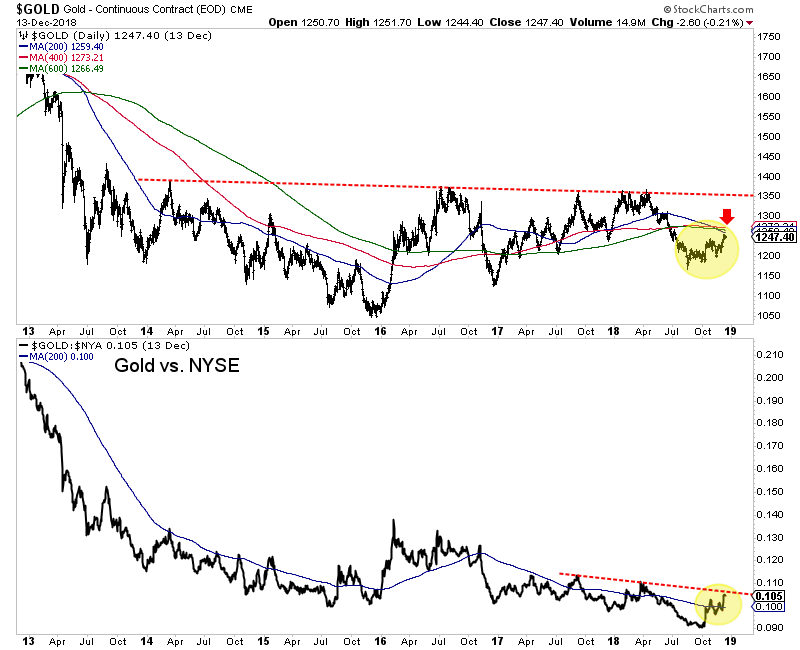

Below we plot Gold and Gold against the broad stock market (NYSE). Gold is still trading below a confluence of resistance ($1260-$1270) and the Gold to stock market ratio, while trading above its 200-day moving average has not broken out of its downtrend yet.

As we pen this, the stock market is breaking lower but Gold is also down and remains below a confluence of resistance at $1260-$1270/oz.

Is our thesis wrong?

The current weakness in equities has not completely changed Fed policy yet. Sure, the weakness in the equity market definitely could cause the Fed to pause its rate hikes and the market has already discounted that for 2019.

However, for the bull market in Gold to be ignited the Fed needs to move from a pause to the start of rate cuts. The current talk is about a pause, not rate cuts.

Hence, Gold is catching a bid and starting to perform better in real terms but has not reached bull market status yet.

Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.