As the stock market bull potentially nears the end of its run and we head into the last two months of 2018, many investors are making adjustments to their portfolios. Over the course of my travels and in conversations with other industry experts, I’m constantly reminded the importance of: 1) understanding the difference between investing and speculating, and 2) understanding risk tolerance.

These are two primary points for any investor seeking to make sound decisions with their money to understand.

1. Know the Difference in Investing vs. Speculating

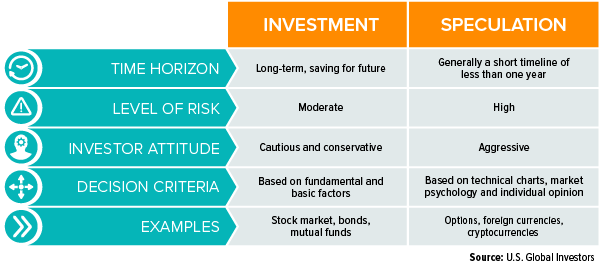

All definitions vary slightly, but most are along the same lines. An investment is an asset or item acquired with the goal of generating income or appreciation in the future. Speculation is a financial transaction that has substantial risk of losing all value, but with the expectation of a significant gain.

Notice how the definition for investment doesn’t include the word “risk.” Of course, every investment carries some level of risk; however, the potential of losing the entire principal investment amount is largely what differentiates investing from speculating. Other factors to consider include time horizon, decision criteria and investor attitude.

Examples of well-known and popular investments include the stock market, bonds, U.S. Treasuries and mutual funds. Assets that fall into speculative territory include options, futures, foreign currencies, startup companies and cryptocurrencies.

Take cryptocurrencies, for example. These digital coins, such as bitcoin and ethereum, surged in popularity late last year and are known for having high volatility, or price swings. Many consider cryptos as speculative assets due to their relatively short existence in the financial world, absence of sound regulation and the many unknowns surrounding trading patterns.

What about the lottery? The Mega Millions made headlines last week for ballooning to the second highest jackpot ever, after failing to find a winner in the 25 drawings since July. Approximately 15.7 million people bought tickets for a one in 303 million chance of selecting the right six numbers, and just one lucky person in South Carolina won the $1.54 billion prize. Is buying a ticket speculating? Or is it perhaps gambling?

I believe it all comes back to the level of risk.

Measuring Risk Through Volatility

Standard deviation, or sigma, is a probability tool that gauges a security’s volatility. Specifically, it measures the typical fluctuation of a security around its mean or average return over a period of time. I often refer to this as an asset’s “DNA of Volatility.”

| One Day | Ten Day | ||

|---|---|---|---|

| S&P 500 Index (S&P) | 1% | 1% | |

| Gold Bullion | 1% | 2% | |

| Bitcoin | 6% | 22% | |

| Ethereum | 6% | 22% |

Take a look at this table comparing an array of assets. Two of the most popular cryptocurrencies, bitcoin and ethereum, both have much higher volatility than the stock market, as measured by the S&P 500. On the other hand, gold bullion is only slightly more volatile than the S&P 500, and has actually outperformed the market since 2000.

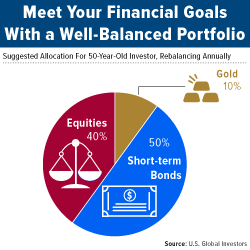

At U.S. Global Investors we advocate investing in gold and gold equities due to its diversification potential. The yellow metal’s DNA of volatility is similar to that of the stock market, and as such we recommend allocating up to 10 percent of your portfolio in the space – we call this the Golden Rule.

Every security has a different sigma for a specific period of time, and as such your expectations as an investor should reflect these differences. An abnormally high sigma, such as those for many cryptos, can signal whether an asset falls into the investment or speculation category.

2. Determine Risk Tolerance and Investment Objectives

It’s no mystery that the investment portfolios of a 35 year old and a 65 year old should look noticeably different. As I’ve written about before, as a person gets older they should have a higher percentage of their money in bonds, for example, assuming their objective at that age is to protect the money they currently have saved for retirement and provide income. Investing in municipal bonds can be a good way to provide tax-free income for investors as they get older and move away from the stock market. A young person’s investment objectives differ significantly because they have a longer time horizon, particularly when it comes to recovering from any losses.

Highly speculative investments can indeed hold a place in some investors’ portfolios, but this should be based on their risk tolerance and goals. Depending on how much volatility you can comfortably withstand, it is prudent to adjust your portfolio accordingly when it comes to speculative investments.

No Risk, No Return

Many Americans haven’t been participating in the stock market bull run and using it to grow their savings. Saving should be a key goal for all, but so too should be growing wealth. Simply stashing away earnings in a savings account won’t protect against the destructive power of inflation, which is where investing and speculating come into play.

Even during increasingly volatile times with many asset classes, investors can still seek returns. We believe one way to potentially take advantage of the recent market turbulence is through active management, rather than passively managed index funds.

We believe informed investors make better investment decisions and that is why one of our core company values is a focus on education. I encourage you to stay updated on the latest market moves by reading our Investment Team’s weekly recap of gold, domestic equities, natural resources, emerging markets and more.

Subscribe to the free weekly newsletter by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Diversification does not protect an investor from market risks and does not assure a profit.

Standard deviation, or sigma, is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.