|

Michael Robinson, chief technology strategist of Money Map Press, is a lot of things: devoted son and father, technologist, avid skier and gun enthusiast, accomplished blues guitarist, Pulitzer Prize nominee.

Readers of his popular newsletters know him for his mantra, "The road to wealth is paved with tech.” As editor of Strategic Tech Investor, Nova-X Report and Radical Technology Profits, Michael has helped curious investors get in early on small-cap and micro-cap names involved in biotech, defense, cannabis research and more.

I got to see Michael’s presentation at the Black Diamond Investment Conference in October and was impressed by his energy, interesting life story and deep knowledge of niche markets.

Below are snippets from our recent discussion, which touches on topics ranging from trap shooting to cannabis legalization to blockchain technology.

Tell us about your start in military tech and biotech.

I grew up in a military household. My dad was a Marine Corps officer, and later he became the senior military editor at Aviation Week & Space Technology. He was among the earliest to write about the Strategic Defense Initiative (SDI), popularly known as Star Wars. So as a high schooler, I was exposed to all of these exotic defense technologies—materials, sensors, warheads and the like—which really gave me a leg up.

My dad and I ran a high-tech military newsletter in the 1980s. This put me in a position to visit Silicon Valley pretty regularly and talk with scientists and CEOs about cutting edge tech—materials that made battleships and submarines quieter, for example.

As a young auto analyst and reporter, I managed to break some big tech stories because I was willing to look away from the mainstream. The biggest story I did actually led to the firing of two executive vice presidents, which cost the bank close to $80 million. The New York Times and Wall Street Journal ended up having to cover the story, so that helped put me on the map.

I got involved in biotechnology later through my work at what was then the Oakland Tribune. The biotech sector was brand new in the mid-80s, and I was in California where it was all happening. While there, I did a five-part series on Betaseron, the first FDA-approved biotech drug to treat multiple sclerosis (MS).

How did you make the leap to the financial world?

That just felt like the natural next step. Every time I left a Silicon Valley presentation on some new tech, I would think: "That’s really cool, but how can you make money off of it?" So even though I consider myself a technologist, I’m always looking at the financial angle.

What’s more, I served on the advisory board of a venture capital company. The experience gave me a different way of evaluating startups than a standard financial analyst, who might be trained only to do ratio analysis and things like that. There’s nothing wrong with ratio analysis, but it’s not going to give you the kinds of insights and instinct you need to figure out which companies really have it together and which don’t.

You’re known to have a strong interest in guns and shooting. Did that come out of your dad’s military background?

I never really thought of it that way. I just love shooting guns. Mostly these days I shoot trap and skeet. I joined the National Rifle Association (NRA) because I wanted to qualify as a Triple Distinguished Expert in pistols, rifles and shotguns. Shotgun was the most difficult, I thought.

The amount of concentration that’s required to shoot at a high level really appeals to me. You have to block out all distractions. In that respect, shooting is a lot like investing. One of the things I remind readers and clients is to separate the signal from the noise. You can’t become a good shot if you can’t block out all the external distractions and things. Similarly, investors must learn to block out short-term market noise before they pull the trigger, so to speak.

Who would you say are your biggest influences?

|

Besides my dad, I would have to say the renowned economist Milton Friedman. I had the great pleasure to interview him once for the American Enterprise Institute (AEI). I remember he had a portrait of himself done, but his wife wouldn’t let him hang it up on the wall in their Nob Hill condo. It’s funny—here’s one of the world’s greatest economic thinkers, a Nobel Prize winner, and he had his portrait just sort of propped up in a corner somewhere.

In any case, Friedman was a huge influence on the way that I think about economics. In my freshman year when I was signing on to be an economics major, I remember reading about how iconoclastic he was, how out of step he was with the rest of the economics community, which was very Keynesian at the time. I learned the true value of contrarianism from studying him and looking at things like freedom to choose. Ayn Rand was another huge influence in that respect.

Michigan just voted to legalize recreational cannabis, making it the first Midwest state to do so. Is this a tipping point?

I think the tipping point probably occurred in 2016, when as many as nine states had cannabis legalization on their ballots. That year is also when we launched our investment report, the Roadmap to Marijuana Millions. All 30 of the stocks we recommended made money. The reason I say that is not to brag about our track record, but to point out that we saw large numbers of new investors coming in, willing to take the risk, wanting to be early and understand the industry.

Michigan, for me, was an affirmation of this critical mass. It’s also a reminder of what we need more of to attract institutional investors: initial public offerings (IPOs), mergers and acquisitions (M&As), up-listings to major exchanges.

Obviously the biggest catalyst would be something out of Washington—an effort to reclassify marijuana off of Schedule I, for instance. I would love to see that happen, as would my dad, the Marine Corps officer, but I don’t believe the support is there right now.

You recently argued that blockchain technology should not be used for voting, for reasons involving secrecy and anonymity. In what industries do you see its application making the most sense?

Literally everything. Supply chain management is a huge area that could benefit from blockchain. Look at the oil industry, which still uses this old paper-based system. Companies that have already shown interest in blockchain are British Petroleum (BP) and Royal Dutch Shell, among others.

Counterfeit goods is a problem that runs in the hundreds of billions of dollar every year. Blockchain can help with that. You can use it to tag and identify goods early on, and then they can be tracked with some kind of a distributed ledger.

Or look at financial services. Frank, you’ve pointed out a number of times before that JPMorgan Chase CEO Jamie Dimon has criticized cryptocurrencies, and yet the bank was quietly investing millions upon millions.

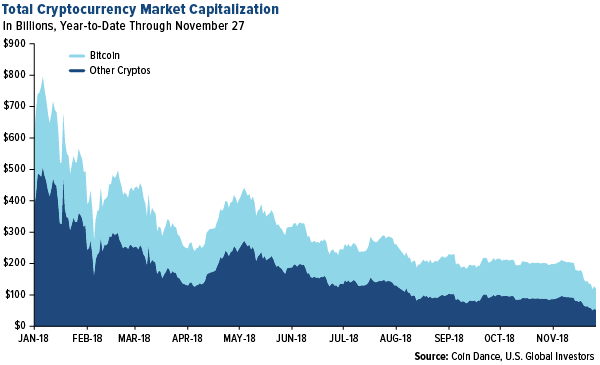

Speaking of cryptocurrencies, they’re down significantly this year. Do you think now is a good time to buy, or is more pain ahead?

I fear about jumping in right now. Are we at the bottom of bitcoin? I don’t know. One thing I do know is that this crypto selloff may be healthy in the long-term. There’s been an insane number of initial coin offerings (ICOs), which have really hurt bitcoin and Ethereum. We need to sweep out some of the smaller coins because 2,000 cryptos is more than the world can possibly absorb. There has to be a shakeout.

You work on several newsletters. Can you describe them for our readers and explain what value they bring?

The main value they bring is making our readers a lot of money. For starters, we have Strategic Tech Investor, which is our free service. The idea is to give investors the rules they need to succeed and not be so emotionally-driven. Because it’s free and it’s open format, we want to educate investors, and hopefully they’ll develop an interest in my investing style and decide to subscribe to one of our paid services.

That brings us to the Nova-X Report and Radical Technology Profits.

Nova-X focuses on mid-cap stocks and the lower end of large-caps. We feel that’s a good comfort zone for entry-level investors who are looking for big trends and ways to make money that aren’t necessarily household names. We try to get to market early.

Radical Tech is our premium service. It’s designed for much more savvy, much more aggressive people. We swing for the fences more than we do with Nova-X. The focus is on any kind of cutting-edge technology—small-caps and even some micro-caps.

As long as my readers make money, I know I’ll do well. I take breaks from time to time, but for the most part I’m up well before dawn screening charts and looking at articles—anything to make our readers as much money as I can.

I want to thank Michael for his time and enthusiasm. Be sure to check out his newsletters!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2018: BP PLC, Royal Dutch Shell PLC.