Yesterday evening marked the beginning of Hanukkah. The Jewish festival of lights commemorates the reclamation of the Holy Temple in Jerusalem from the Syrian-Greeks in the second century BCE. According to accounts, after Judah and his forces liberated the temple, he found only one jar of oil, good for a single day’s lighting at the most. Miraculously, though, the oil lasted for an incredible eight days, which is why Hanukkah is celebrated for eight days and nights to this day. To all of my Jewish friends around the world, I wish you a Hanukkah Sameach!

Among many of the holiday’s well-known traditions, at least here in the U.S., is to give children chocolate coins. This arose from the centuries-old practice of parents giving real coins, or Hanukkah gelt, to their kids, who in turn were expected to give them to their teachers.

I believe this is a beautiful custom. Whether you observe Hanukkah, Christmas, Eid al-Fitr, Diwali or any number of other religious holidays around the world, gifting your children and grandchildren coins of precious metals such as gold or silver could be made into a tradition in your own family. I encourage you to see the unique gifts that Kitco Metals offers in both silver and gold.

Holiday Deals at Your Local Coin Dealer

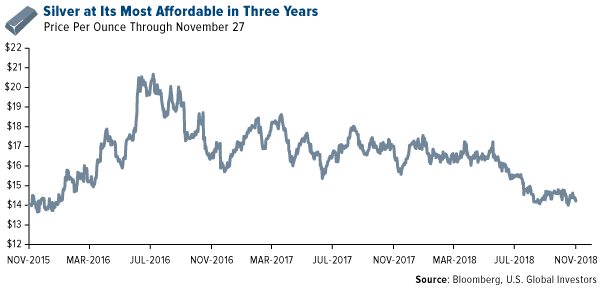

Take a look at silver. The white metal is on sale right now, trading at a little more than $14 an ounce. That’s the most affordable it’s been in three years. Not only does a silver coin cost quite a bit less than, say, a video game, it lasts much, much longer. And unlike a video game, it has the potential to rise in value.

Gold is admittedly more expensive, trading just under $1,240 as of today. But there again, if you’re already planning to go all out on gift shopping this holiday season, you might as well make it something that’s truly memorable, holds it value and lasts forever.

It need not be a coin. Pure, 24-karat gold jewelry holds its value just as well as a coin, and it has the added bonus of being wearable. I’ve told you about Menë, the newcomer that aims to disrupt the fine jewelry industry. The Toronto-based company just announced that it surpassed 10,000 orders from customers in more than 50 countries, all less than a year since going public in January 2018.

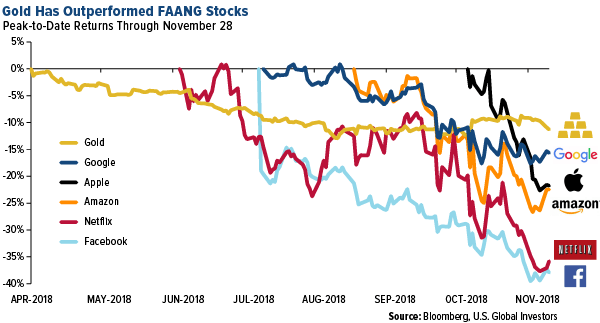

Speaking of holding its value, notice how the price of gold has held up well against stock market volatility this year. Gold sentiment among some investors is room temperature right now, but it’s important to put things in perspective. Compared to some popular internet stocks, the metal’s losses have not been nearly as sharp or deep. From its 2018 peak in early April to today, gold has declined around 10 percent. Facebook, meanwhile, has dropped close to 40 percent since its peak at the end of July; Netflix, as much as 36 percent since June.

Has the U.S. Dollar Peaked?

With less than a month left to go in 2018, gold is down around 6 percent. If it stays in this range, gold will log its first year of negative returns since 2015. This is largely thanks to the U.S. dollar, which has strengthened on additional interest rate hikes.

Although it’s probably too early to call a peak, there are some indications that the dollar might be set to cool in 2019. This would allow gold, silver and other metals not only to appreciate in price but also potentially outperform stocks.

Among the most compelling signs that the dollar is close to a top comes from Dutch financial services group ING. According to its analysts, the ballooning U.S. twin deficit—which combines the government budget balance and the current account balance—is projected to weaken the U.S. currency as it did in past cycles.

As I’ve shared with you before, the government is set to run trillion-dollar deficits for the next four years, and this will likely prove to be a heavy burden on the dollar. “Unlike the dollar rally seen in the late-1990s, when a productivity boom helped deliver a budget surplus, this year’s dollar rally has been built on unfunded tax cuts,” ING’s strategists write. The group adds that it “expects funding these deficits to become more difficult.”

ING isn’t alone in its view. Bloomberg Intelligence Commodity Strategist Mike McGlone believes that the “trade-weighted broad dollar is near a peak and silver a bottom… and the potential for mean reversion should outweigh continuing-the-trend risks. Silver, among the most negatively correlated to the dollar and positively to industrial metals, appears ready for a potential longer-term recovery.”

Not One Ivy League Endowment Beat a Simple 60-40 Portfolio Over 10 Years

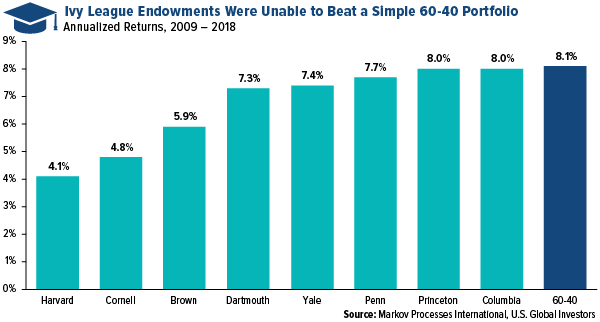

On a final note, a study last week showed that eight Ivy League endowments were unable to beat the 10-year annualized returns of a simple 60-40 portfolio, with 60 percent in U.S. stocks, 40 percent in bonds.

Markov Processes International (MPI), a quantitative analytics research firm, has been assessing the performance of endowment funds managed by some of the top universities in the U.S. Although all eight funds beat the 60-40 benchmark in fiscal year 2017, none managed to beat it on an annualized basis over the past 10 years. In fact, the 60-40 portfolio—one of the most common asset allocation structures, available to retail investors through a simple S&P 500 Index fund and fixed-income fund—outperformed the bottom university fund, Harvard’s, by 360 basis points.

The “Ivies” not only lagged the benchmark but were also accompanied by much higher risk. Over the past 10 years, the 60-40 portfolio had a standard deviation of 9.1 percent, whereas the riskier endowment funds had one as high as 13.8 percent (in the case of Yale and Cornell) and 13.6 percent (in the case of Harvard).

The implication, I believe, is you don’t necessarily need access to the fanciest, most sophisticated tools and strategies to maximize your investments. MPI shows that a basic portfolio, composed of high-quality domestic equity funds and short-term Treasury and municipal bond funds—all of which we’re proud to provide, I might add—is suitable for most retail investors seeking attractive risk-adjusted returns.

Curious to learn more? Watch my comprehensive interview with Kitco News’ Daniela Cambone by clicking here!

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a quantity calculated to indicate the extent of deviation for a group as a whole. A trade-weighted dollar is a measurement of the foreign exchange value of the U.S. dollar compared against certain foreign currencies. A basis point is one hundredth of one percent, used chiefly in expressing different of interest rates.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 09/30/2018: Mene Inc.