By Jody Chudley

This post Crisis Alert: The $80,000 Job Nobody Wants Is Costing You Money! appeared first on Daily Reckoning.

It is a problem impacting everyone, including you.

And it is hitting us right where it hurts — in the wallet.

The issue is a massive shortage of truck drivers in the United States. American Trucking Associations believe that we need at least 50,000 additional truck drivers, and we need them today.1

It isn’t hard to fathom how a shortage of truck drivers impacts all of us financially. Just take a look around you right now…

If something is in your home, then it has at some point been on a truck.

To attract new drivers companies have had to pay more. On top of that we also have rising fuel costs.

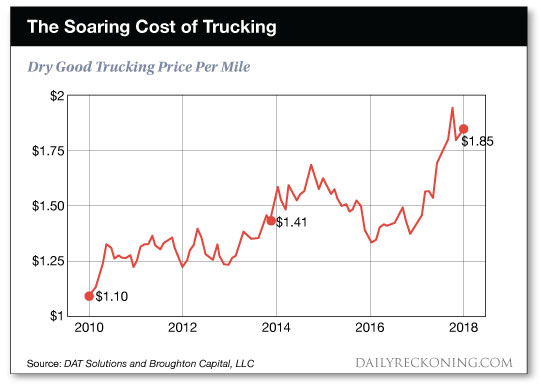

The cost of shipping a “dry good” (one that doesn’t require refrigeration or special conditions) by truck has risen by almost 80 percent since 2010 and 40 percent in the past year alone.

These increased trucking costs are impacting nearly every company that is in the business of selling goods.

Tyson Foods (TSN: NYSE) for example has indicated that its shipping costs will increase by a whopping $200 million this year. It doesn’t matter what is being shipped, if it is going by truck it will cost more.

You know what happens when corporations see their costs rise. They pass those cost increases on to us, the consumers. Since virtually everything we consume gets shipped to us, that means we are going to be paying more for everything.

Were you wondering why the cost of your Amazon Prime membership jumped from $99 to $119? This truck driver shortage is it.

Worse still, this is not going to be a temporary problem.

With e-commerce growing at a rapid pace, an even greater strain will be placed on our transportation system and the truck driver shortage will grow.

Expectations are that we will need nearly 900,000 new drivers over the next decade to keep up with the growth in demand for freight transportation.2 There is no way that the trucking industry attracts all of those bodies without continuing to offering higher and higher compensation…

We Can Eat These Cost Increases Or We Can Do Something About Them

It is pretty clear that as consumers, we are going to be bearing the brunt of these shipping cost increases over the coming decade.

It therefore makes sense for us as investors to hedge way our exposure to what is coming.

So how do we do that? How do we profit from truck driver wages rising?

Next to becoming truck drivers ourselves, the most obvious way to do that is by owning the railroads which become much more competitive as the cost of trucking goes up.

Interestingly, we wouldn’t be the first smart investors to see opportunity in the railroads. Warren Buffett purchased all of Burlington Northern Santa Fe in 2009 for his company Berkshire Hathaway, and his pal Bill Gates has owned a significant position in the Canadian National Railway since 2002.3

The specific railway that I like best right now is Kansas City Southern (KSU: NYSE). My preference for Kansas City Southern today is based entirely on one thing, the shares of the company are cheap.

At just over 11 times earnings, KSU is trading at a lower multiple than it has for years.

The reason for Kansas City Southern’s depressed valuation is concern over the North American Free Trade Agreement (NAFTA). KSU has built an expansive rail network that connects the U.S. heartland to Mexico, and President Trump’s threats to exit from the existing NAFTA deal have cast a shadow over KSU’s share price.

I believe that any concerns over the U.S. exiting NAFTA are more than priced into this stock. The market has accepted the idea that NAFTA and trade in North America are going to crumble.

In doing so, the market has missed how much Kansas City Southern is going to benefit from a boom in the petrochemical business that is happening on the Gulf Coast. The market has also missed this company has just completed spending on two major capex projects and is going to see a $100 million reduction in spending this year. That means increased free cash flows which means more money for dividends and share repurchases.

Today, shares of Kansas City Southern are priced for the complete death of NAFTA. As they old saying goes, “if it’s in the news, it’s in the stock.”

I think there is significant upside here even if NAFTA disintegrates because of the items the market has missed. Should we get a resolution to this NAFTA issue that is any less than disastrous for trade with Mexico, this stock will move higher in a hurry.

That means that these shares don’t have much room to fall, but oodles of room to rise. That is especially true with the demand for railroad shipments increasing as the cost of shipping by truck rises.

This is the kind of risk/reward trade that we should always be looking for.

Here’s to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1America has a massive truck driver shortage. Here’s why few want an $80,000 job., WaPo

2There Aren’t Enough Truckers, and That’s Pinching U.S. Profits, Bloomberg

3BILL & MELINDA GATES FOUNDATION TRUST, Whale Wisdom

The post Crisis Alert: The $80,000 Job Nobody Wants Is Costing You Money! appeared first on Daily Reckoning.

From:: Daily Reckoning