Source: Streetwise Reports 07/09/2018

In a period of economic uncertainty exacerbated by threats of a trade war, Samuel Pelaez, chief investment officer and portfolio manager with Galileo Global Equity Advisors, delves beyond the headlines to discuss the factors that are influencing gold, oil and other commodities, and why he believes we are on the cusp of a once-in-a-lifetime opportunity in commodities.

The Gold Report: Sam, recently we’ve seen a major intersection of the markets with politics. Would you touch on macroeconomic themes you see happening with politics, gold and other precious metals?

Samuel Pelaez: This is probably one of the times, in recent memory at least, when we’ve seen the greatest level of political interference in markets. In particular, trade has an enormous impact on the world of resources. The United States and China are the two largest producers and consumers, importers and exporters of resources globally, so any news headline involving trade between the two nations, and now protectionism and potential trade wars, would have a disruptive effect on resource markets. We’ve actually seen quite a bit of that over the last two or three months, and it only appears to be intensifying as we go deeper into the summer.

There are a lot of signals that would suggest this is probably not the greatest time to be investing in resources. But once I list those points, I’d like to show how this actually may be setting up one of the greatest opportunities that we’ve had in a couple of generations to be allocating to the resource market. I’ll start with the negatives and then slowly transition into how this could be an opportunity.

To begin with, we have a pretty aggressive tone from the U.S. toward China as it relates to trade. If the U.S. levies additional import tariffs or duties on resources, the U.S. being the largest importer of many of them, that suggests domestic production will do well. But domestic production is insufficient, so it’s going to increase the price of some of these commodities in the short term. But over the long term, this increase in price may actually have a detrimental effect on the economy. If the U.S. levies imports on iron ore or steel, then the price of construction goes up in the U.S.; the price of car manufacturing and cars as a general consumption product also go up. And over time, this has a nefarious effect on the economy and on consumption.

Initially the tariffs may be read as a positive, but it has very negative implications for the economy as a whole. Very early on in the conversations about steel import duties, I saw a chart that showed there are about 330,000 Americans who work, directly or indirectly, in the steel industry, but there are more than 330 million Americans who ride in cars daily. The protectionist measures help a substantial amount of people, 330,000, and the communities around them, but it has a negative effect on the pockets and the economics of families of 330-plus million people. This has a disruptive effect on the resource universe.

The other thing that’s been impacting commodities and natural resources negatively in recent times is the slowdown in economic activity globally. Since 2016, we were in a pretty strong upward trajectory as measured by the Purchasing Managers Index (PMI). PMI is one of our favorite economic indicators because it’s has some statistical predictive power as to what’s going to happen with the price of resources in the future. The PMIs turned around the end of 2015/early 2016. Up until the beginning of this year, they were in a very strong uptrend. Since then, we’ve started to see them slow down. We are still in expansionary territory, which is positive, but we’ve started to see them slow down to a point where the resource world may have to adjust to that new level of demand growth.

With those negatives in mind, we’ve seen a few of the major commodities—not oil, which is in a specific category that I will touch on later—haven’t had a good year. As of June end, copper, the most important base metal, is down nearly 10% year to date. Iron ore is down 9%. Coal is also down. Gold prices are down as well. This reflects the slowdown.

TGR: With all these negatives, why do you say we have a once-in-a-lifetime opportunity in resources?

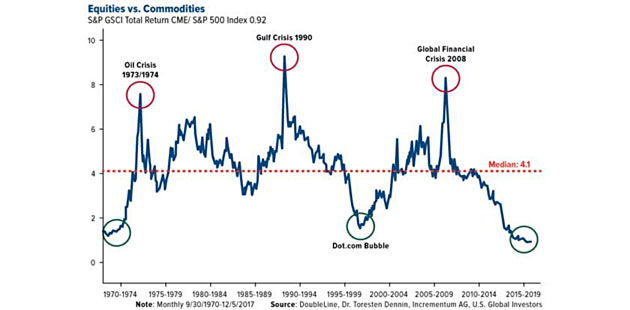

SP: There is a chart that we’ve been discussing over the last year or so. Jeff Gundlach from DoubleLine Capital LP included this chart in his 2017 year-end review, suggesting that we’re near the beginning of a new cycle, and resources are one of the sectors of the market that should perform best going forward. The chart shows the S&P Commodities index, divided by the S&P 500 Index. The chart measures how many units of resources you can buy with a unit of the S&P 500. This chart has never been at a lower level than where it’s sitting right now, suggesting we may see a major mean reversion where the S&P Commodities Index outperforms the S&P 500 Index for a number of years.

The last time the ratio was at these levels was in the dot-com bubble. Remember, there was a lot of exuberance in the markets; lots of growth expectation and technology was leading the markets. Resources was not a sector that people were allocating to. And that was the genesis of the later industrialization of China. It was a great catalyst. And from then, the S&P Commodities Index outperformed the S&P 500 Index by a factor of about 4:1 over the next decade.

This chart shows that we’re in a similar predicament right now. If we go back to what happened two decades ago, there’s going to be an opportunity where resources have the potential to outperform the overall broader market, as measured by the S&P 500, by multiples. Last time, …read more

From:: The Gold Report