By Pia Rivera

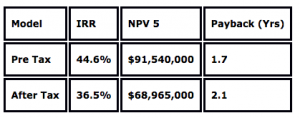

FIRESTEEL RESOURCES INC. (TSXV:FTR) (“Firesteel”, “Company”) today announced the results of an economically positive Preliminary Economic Assessment (“PEA”) for the Company’s 100% owned Laiva Gold Mine (“Laiva”), near Raahe in Finland. Laiva is a past producing gold mine that has been on care and maintenance since 2014 and is now 100% owned by Firesteel.

The mine is fully built, fully permitted and financed to production via a gold forward sale. Production is scheduled to start in the 4th quarter of 2018. The PEA was conducted by John T. Boyd Company of Denver, Colorado (“Boyd”). The final report will be filed on SEDAR within 45 days of this announcement.

Other Highlights include:

-Pre-production capex $7,115,103

-75,981 ounces of average annual gold production at a cash cost of $863 per ounce and AISC of $974 per ounce

-Measured mineral resources of 355,000 tonnes at 1.132 g/t Au and Indicated mineral resources of 3,442,000 tonnes at 1.248 g/t Au

-Inferred mineral resources of 9,030,000 tonnes at 1.531 g/t Au

-Mill grade of 1.45 grams per tonne with a recovery of 90.4%

-Life of Mine production of 456,600 ounces gold over a 6-year mine life

The PEA is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

As previously announced, when Firesteel acquired the Laiva Mine, the Company was granted, EUR131,716,248 in tax loss provisions which may be used to offset future taxes should taxable income be earned in Finland prior to expiration of the tax loss carry forwards. The tax loss provisions expire between 2020 and 2028 (see the Company’s audited financial statements for the year ended January 31, 2018 for detailed disclosure of the expiration schedule). The recognition of the tax loss carry forwards have a material impact on the economic assessment of the Laiva Gold Mine project and are contingent upon the Company achieving taxable net income per Finnish tax laws.

Michael Hepworth, President and CEO of Firesteel commented; “The release of the details of this study is an important milestone. Although we had previously conducted an extensive internal study used for financing and had already made the decision to advance to production, for the benefit of the market, we needed confirmation from a more formal study. In addition, the three exploration properties offer significant blue-sky exploration potential. It is our intention to more fully explore these properties with an extensive drill program in early 2019. Our goal is to have additional pits close to the mill.”

Firesteel’s management has identified several opportunities outside of the scope of the mine plan studied in the PEA, which could further improve the mine plan and the economics of the project. Most important of these being the three additional 100% owned exploration properties close to the mine. Firesteel is currently conducting magnetic surveys on all of the company’s properties. All three properties are fully permitted for exploration.

Mineral Resources:

Mineral Resources were prepared by JT Boyd (Firesteel Press Release August 21, 2017).

| Classification | Au g/t | Tonnes | Contained Au (troy ozs) |

| Measured | 1.132 | 355,000 | 13,000 |

| Indicated | 1.248 | 3,442,000 | 138,000 |

| Measured + Indicated | 1.237 | 3,797,000 | 151,000 |

| Inferred | 1.531 | 9,030,000 | 445,000 |

- 1.The effective date of the estimate is August 9, 2017.

- 2.The mineral resources presented here were estimated using a block model with a block size of 9 m by 9 m by 9 m sub-blocked to a minimum of 3 m by 3 m by 3 m using ID3 methods for grade estimation. All mineral resources are reported using an open pit gold cut-off of 0.40 g/t Au.

- 3.Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues.

- 4.The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be expected to be upgraded to an Indicated Mineral Resource with continued exploration.

- 5.Other than an economic pit shell no attempt has been made to apply a mining dilution or a mining recovery factor.

- 6.Mineral resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definition and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

- 7.Numbers may not add due to rounding.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Paul Sarjeant, P.Geo., a Qualified Person under National Instrument 43-101 and a director of the Company.

Technical Report

For readers to fully understand the information in this news release, they should read the PEA technical report in its entirety which the Company expects to file in accordance with NI 43-101 within 45 days from the date of this news release on SEDAR (www.sedar.com). The report will also be available at that time on the Firesteel website, including all qualifications, assumptions and exclusions that relate to the PEA. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Disclosure: Companies typically rely on comprehensive feasibility reports on mineral reserve estimates to reduce the risks and uncertainties associated with a production decision. The Company has not completed a feasibility study on, nor has the Company completed a mineral reserve estimate at the Laiva Mine and as such the financial and technical viability is deemed to have higher risk than if this work had been completed. Based on historical engineering and geological reports, historical production data and current engineering work completed or in process by Firesteel, the Company intends to move …read more

From:: Investing News Network