Jay Taylor doesn’t beat around the bush — he believes the price of gold is being suppressed to support the U.S. dollar and underwrite American foreign policy. But the publisher and editor of J. Taylor’s Gold, Energy & Tech Stocks and host of the radio show “Turning Hard Times into Good Times” thinks that this suppression will fail, just as it did in the 1970s, when gold rose over 2,300%. In this interview with The Gold Report, Taylor urges investors to stay as liquid as possible so they can invest in undervalued companies poised to explode when the value of gold is reasserted.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor’s interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career — including publication of his weekly J. Taylor’s Gold, Energy & Tech Stocks newsletter. He also has a radio program, “Turning Hard Times Into Good Times.“

Interview by Kevin Michael Grace of The Gold Report

The Gold Report: The price of gold has fallen more than $130 an ounce ($130/oz) since July. Why?

Jay Taylor: I believe we have two different markets. One is an honest market for physical metal. The other is a market that has increasingly become less than honest. The latter is a paper market, primarily in London and New York, and it is used to muddy the waters of price discovery with gold and silver. This paper market price is assumed to be the real price of gold. I don’t think that’s true.

There is a need on the part of Wall Street, and the ruling elite within the Anglo-American empire, to keep people uninterested in honest money and real gold because dishonest enterprises must keep people from knowing the truth. What we have essentially is a fiat currency system that is devised to allow those in charge of the monetary system to profit at the expense of the real producers of wealth: the miners, the manufacturers, the farmers, the inventors. The people that produce useful things are having their wealth confiscated clandestinely by this monetary scheme.

TGR: You have written that “the rigging in the gold price in New York and London is accomplished by a handful of major bullion banks that just happen to be the biggest shareholders of the Federal Reserve.” How is this rigging accomplished?

JT: It’s accomplished through massive futures markets selling on the Comex and the London markets. It is like a casino. There is a 100 to 1 ratio of gold futures bought to actual gold settlement. We see huge amounts of selling coming into the market at exactly the times we would expect gold to do well. The futures markets are so highly leveraged that a very small amount of actual dollars are needed to drive the gold price down.

“Almaden Minerals Ltd.’s Ixtaca has developed quite nicely into a low-cost, multimillion-ounce project.“

The players here, the big banks, have the largest shareholdings of the Federal Reserve. They have access to massive amounts of money created out of nothing. It is interesting to note that, especially for platinum, palladium and silver, a large premium, up to 24% in the case of palladium, is being paid by people in the physical markets of Shanghai. The premium for silver has been around 14%, and the premium for platinum has been between that of palladium and silver.

TGR: In retrospect, was the creation of gold exchange-traded funds (ETFs) a mistake?

JT: I don’t think so. We must distinguish between those gold ETFs that are honest and those that might not be so honest. Among the good ones are the Merk Gold Trust ETF (OUNZ), which allows investors to actually take delivery of physical gold. Another good one is the Central Fund of Canada Ltd. (CEF:NYSE.MKT; CEF.A:TSX), which publishes a quarterly audit of the amount of gold, silver and cash that backs each share. The Sprott ETFs are honest as well, and at least one Sprott fund allows investors to take delivery of gold, albeit a larger number of ounces than the Merk Gold Trust, which is designed more for retail clients who wish to turn their shares into gold.

TGR: The rigging downward of gold, silver and other metals would obviously harm the mining industry profoundly. So why isn’t the industry complaining?

JT: I don’t think the major mining companies understand the product they’re selling. I don’t think they understand that gold, and to a lesser degree, silver, are, in fact, money designed by nature and not decreed by human beings. They have been taught to believe, by men and women with Ph.D.s from Princeton, Harvard and Yale, that gold is a “barbarous relic.” There may be an exception here and there, with CEOs of major gold mining companies. Rob McEwen of McEwen Mining Inc. (MUX:TSX; MUX:NYSE), for example, understood this truth and said it many times when he headed Goldcorp Inc. (G:TSX; GG:NYSE).

“Precipitate Gold Corp. is a low-cost stock that could evolve into something very considerable.“

The World Gold Council, which is funded by those same CEOs who do not understand the product they sell, promotes gold as jewelry. That is simply, with all due respect, asinine because the greater the amount of gold taken off the market for jewelry, the lower gold is priced. What would really boost the gold industry would be an understanding that gold is honest money and that fiat money is dishonest. A lot of the junior miners sort of understand this. They’re more supportive of the Gold Anti-Trust Action Committee (GATA).

TGR: How long can this rigging continue?

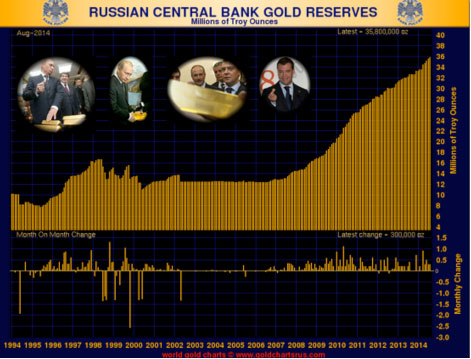

JT: It’s really a question of how long confidence in the U.S. dollar can be maintained. The BRIC countries are forming their own financial infrastructure to compete with the dollar. Sanctions directed by the United States against Russia are pushing Russia into the arms of China, which makes the BRIC countries stronger. China is the largest gold producer in the world and has supposedly imported huge amounts of gold in recent years. Also, as tensions with Russia have been rising, that country has also has been importing large amounts of gold, as the chart below illustrates.

If we had an honest monetary system with gold at the center, we could not issue endless amounts of money to finance the war machinery. The U.S. went off the gold standard in 1971 because it wanted socialism and the ability to wage war without telling the people they had to pay for it. I don’t know how long our pathological monetary system can last, but the handwriting is on the wall. As I look at the continuing decline of western economies, including that of the U.S., I feel the day of reckoning is drawing near. I can’t imagine we won’t see a major breakdown in the global financial system within a year from now.

TGR: Capital continues to seek the U.S. dollar. The Dow and the S&P 500 continue to hit record highs, while the headline unemployment number falls. Are we looking at an economic recovery, or could we face another repeat of the 2007–2008 crisis?

JT: I don’t believe that we’ve had a recovery. If we have, it’s the most tepid in history. The number of people in the labor force continues to decline, and inflation is certainly not the 1% or 2% our government pretends it is. The top 1% in the western world have done extremely well, while the middle class is being hollowed out. Talk of recovery is a fraud that keeps people pacified. The large corporate interests in America don’t want change because the banks, through the Federal Reserve, can print all the dollars they want, and they now have purchased Congress and the executive branch of the American government.

TGR: How does the present situation for gold resemble what happened in the late 1970s, when it rose more than 2,300%?

JT: There is a case to be made that a much bigger rise could occur. The ratio of money being created relative to GDP — even if you take the government’s GDP numbers at face value, which I do not — is much greater now than it was in the 1970s.

“Mandalay Resources Corp. is making money and paying a bit of a dividend.“

I’m still agnostic as to whether the economy goes into hyperinflation or massive deflation. After a deflationary implosion, the nominal price of gold would not necessarily rise, but its purchasing power would rise dramatically. If the masses become outraged over the fall in their living standards, we could see money printed and thrown to them from helicopters. I pray to God that doesn’t happen, because hyperinflation is the worst of all outcomes. The debasement of the dollar will continue. If this leads to a flight from the dollar, we could see a sudden and dramatic shift of capital from paper money into real goods, such as gold.

TGR: Will gold stocks lead or lag the gold price breakout?

JT: I think they have been leading already. My gold share values are up low double digits from the bottom. I’m seeing wonderful opportunities in precious metals equities. These markets are true markets, unlike the fraudulent paper markets for gold and silver.

TGR: One of your major holdings was just bought out by Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), correct?

JT: That’s right. Cayden Resources Inc. (CYD:TSX.V; CDKNF:OTCQX) is my second largest holding. The company has agreed to be purchased by Agnico Eagle for $205 million ($205M). I was a bit disappointed at first, because we could have seen a much higher number in the longer run. That said, there’s no question that a bird in the hand is better than two in the bush. As Ivan Bebek, Cayden’s CEO, recently noted on my radio show, the company is now derisked, having exchanged shares of Cayden for Agnico Eagle, which is a very strong gold mining company. Agnico Eagle is one of my favorite senior gold mining companies because it has been very careful about protecting its margins. It’s a stock I could easily see doubling or tripling when the real price of gold resumes its upward trek.

TGR: What’s Ivan Bebek going to do in the future?

JT: Ivan and Shawn Wallace, Cayden’s chairman, are definitely on to their next deal. This was their second success. Their first was Keegan Resources, which is now Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT). I think that investors need to follow the successful jockeys. I’m certainly looking forward to what they will do next.

TGR: Which other companies do you like in Mexico?

JT: Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE) is one that I like a lot. The company is a project generator, but it has focused on the Ixtaca gold-silver project. This has developed quite nicely into a low-cost, multimillion-ounce project.

The company released an updated preliminary economic assessment of Ixtaca on Sept. 3. Its initial capital expense has been reduced 19% to $399M. Its pre-tax net present value is now $842M, and its pre-tax internal rate of return is 37%. The after-tax payback period is 2.5 years.

TGR: What prices did Almaden use for its base case scenario?

JT: The base case is $1,320/oz gold and $21/oz silver. I expect a gold price rise would be very positive for the company.

I also like SilverCrest Mines Inc. (SVL:TSX; SVLC:NYSE.MKT) a lot, because the company always does what it says it is going to do. It started producing on a small scale, and uses its cash flows to grow the company. SilverCrest is going to 3,000 tons a day, and this will increase production dramatically. The company earned $0.03/share during the first six months of this year, but its cash costs fell by 2% to $7.66 per equivalent ounce of silver produced. I expect this company will continue to grow organically without shareholder dilution.

“Columbus Gold Corp. CEO Robert Giustra has done a remarkable job, and I think the probability of success is quite high.“

Another Mexican company I like isParamount Gold and Silver Corp. (PZG:NYSE.MKT; PZG:TSX). It’s trading at only $0.92/share now, but it has 2.4 million ounces (2.4 Moz) of gold equivalent at San Miguel, and at the Sleeper mine in Nevada, where the latest NI 43-101 resource totaled 3.5 Moz in the Measured and Indicated categories, and just under 2 Moz in the Inferred category. This company has deep pockets supporting it.

TGR: Which companies do you prefer in the Caribbean and South America?

JT: I have Precipitate Gold Corp. (PRG:TSX.V) on my list. The company has good exploration potential in the Dominican Republic. In fact, the company just announced a discovery hole on its Ginger Ridge project. Specifically, it intersected approximately 0.4 oz/ton gold over 5 meters (5m) and 0.145 oz/ton over 18m. Ginger Ridge is close to the GoldQuest Mining Corp. (GQC:TSX.V) discovery, where a 2+ Moz gold resource was outlined. GoldQuest is also on my list. Precipitate is a low-cost stock that could evolve into something very considerable. Obviously, this discovery hole improves the odds.

Mandalay Resources Corp. (MND:TSX) is making money and paying a bit of a dividend. The company has operations in Chile, Australia and now in Sweden, after its takeover of Elgin Mining. I also like companies in French Guiana and Guyana.

TGR: Such as?

JT: In French Guiana, I love Columbus Gold Corp. (CGT:TSX.V; CBGDF:OTCQX) and its Paul Isnard project. The company was smart enough not to go it alone. Instead, Columbus brought in a large, successful Russian mining company, Nordgold N.V. (NORD:LSE). Nordgold will take it to production, or at least feasibility, with Columbus keeping just under 50%. I like French Guiana because it has French law. Columbus CEO Robert Giustra has done a remarkable job, and I think the probability of success is quite high. With the stock selling at around $0.45, I think the upside is phenomenal, especially when the next leg of the gold bull market gets underway.

“I believe Klondex Mines Ltd. will continue to grow its production organically as it takes advantage of excess mill capacity.”

Next door, in Guyana, Goldsource Mines Inc. (GXS:TSX.V) has the same management team as SilverCrest, and will begin producing gold this year. This stock sells for only $0.20 now. It could easily become a five- or tenbagger within the next year, because it will likely produce gold at $480/oz. Goldsource is going to mine the saprolites only, just taking the low-hanging fruit, before it explores for hard rock potential. If a sizeable hard rock resource is found, it will likely look for a partner.

TGR: Ecuador is not a country we’ve associated with foreign mining companies for some time, but you’re interested in a company there, are you not?

JT: Cornerstone Capital Resources Inc. (CGP:TSX.V; GWN:FSE; CTNXF:OTCBB) is a project generator. It has had some phenomenal intercepts at the Cascabel copper–gold prospect. For example, a hole announced on Aug. 26 scored 0.4% copper and 0.17 grams per ton (0.17 g/t) gold over 958m. An earlier hole scored 0.46% copper and 0.18 g/t gold over 597.26m. The one thing I’m hesitant about is that its Australian junior partner, SolGold Plc (SOLG:LSE), is not terribly well financed. That said, this could be a tenbagger very quickly.

TGR: Which Canadian gold companies do you like?

JT: There are a lot of them. Klondex Mines Ltd. (KDX:TSX; KLNDF:OTCBB), which is operating in Nevada, looks really good for its high grade resource. It recently reported its first profit. It has really turned the corner since it acquired the Midas mill and mine from Newmont Mining Corp. (NEM:NYSE). It is trucking high-grade ore (more than 1 oz/ton much of the time) 100 miles from its Fire Creek property to the Midas mill. But both the Fire Creek project and the Midas mine have substantial exploration potential. I believe this company will continue to grow its production organically as it takes advantage of excess mill capacity.

Premier Gold Mines Ltd. (PG:TSX) is one of my favorites. The company has three great projects in Ontario and Nevada. It owns 100% of the Trans-Canada property in Ontario, and holds a 49% interest in the Rahill-Bonanza project, with Goldcorp holding 51%. Premier recently acquired a 100% interest in the Cove gold project in Nevada, having purchased Newmont’s interest. I believe this is one of the best development companies out there, with not one but three potential company-making gold mining projects advancing toward production.

TerraX Minerals Inc. (TXR:TSX.V), a new entry on my list, has the Yellowknife City gold project in the Northwest Territories. The company is 9.7% owned by Virginia Mines Inc. (VGQ:TSX), which has increased my confidence level. Management is in the process of pulling together data from some 463 previous drill holes, but what is most exciting is the fact that the southern end of the company’s Northbelt property hosts the northern extension of the Yellowknife Gold Belt, which hosted the famous 8.1 Moz Giant Deposit and the 6.1 Moz Con deposit. The company’s management team is technically strong and has skin in the game.

The final one I’ll mention in Canada is Balmoral Resources Ltd. (BAR:TSX; BAMLF:OTCQX). The company has projects straddling the Ontario-Quebec border. It has a high-grade gold discovery on its Detour trend project at the Martiniere claim group, located 45 kilometers from the Detour Gold deposit. Also in this group of claims, which measures 700 square kilometers, the company has made a nickel and platinum group metal discovery This is a very successful company from an equity point of view and from an exploration point of view.

TGR: Do you like any companies in Asia?

JT: I am very excited about Novo Resources Corp. (NVO:CNSX; NSRPF:OTCQX) and its Pilbara gold project in Australia. CEO Quinton Hennigh has begun work on a bankable feasibility study for lower grade surface material. It’s free milling gold, which should be very low cost, almost like a saprolite in the amount of effort required to win the gold from the hosting material.

“TerraX Minerals Inc.’smanagement team is technically strong and has skin in the game.“

Newmont Mining Corp. owns 32% of Novo, and management owns a big chunk of stock. Newmont just finished using its propriety bulk leach extractable gold (BLEG) surveying technology to outline huge masses of prospective land for finding what the company hopes will be the next Witwatersrand deposit. I expect that, before the end of this year, its resource will grow very dramatically. Novo is also going to put down a couple of deep holes this year.

TGR: You mentioned Witwatersrand. What’s the connection?

JT: The Witwatersrand Basin in South Africa has produced 1.5 billion ounces of gold, about one-third to one-half of all the gold ever produced. Quinton Hennigh, who is a geologist, believes that he has found the same kind of environment at Pilbara. If Novo were to hit what is known as the carbon leader that’s typical of the Witwatersrand, then I think this stock would be a rocket shot to the moon in no time. I was talking to Rick Rule about this recently, and Rick says if Novo really intersects that carbon leader, which is deeper down in the ancient seabed, then it will have to stop worrying about putting together a bankable feasibility study and just drill the heck out of this thing.

“Balmoral Resources Ltd. is a very successful company from an equity point of view and from an exploration point of view.“

Quinton has studied Witwatersrand rock and has been developing this hypothesis for many years. Novo is an Australian company, so political risk is relatively limited. Pilbara has the prospects of near-term production combined with the possibility of a major discovery. Novo is very well financed, with about $14M in cash.

TGR: Some investors are put off Novo because it isn’t listed on the Toronto Stock Exchange (TSX).

JT: That doesn’t bother me, but I expect it will be listed on the TSX or another senior exchange shortly. Novo is actually very illiquid now. To give you an example, I probably have more shares of this company than I should. I wanted to sell some to buy something else I thought looked attractive. The stock was at just over $1.10/share when I went to sell. I sold 1,100 shares, and that transaction took it to just below $1/share.

TGR: You have stated your firm belief that the price of gold cannot remain suppressed for much longer. But as John Maynard Keynes reminded us, “Markets can remain irrational a lot longer than you and I can remain solvent.” Many investors in gold companies have felt the sting of Keynes’ word for more than three years now. What should they do?

JT: Well-managed companies with good projects and the ability to raise money will survive. Many juniors are not in that position, and will be gobbled up or be subjected to the huge rollbacks that kill early investors. Obviously, not putting all your eggs in the precious metals basket would have been wise, and still is. I do not, however, advocate big investments in the wider equities markets now, because they are long in the tooth and could be rolled back substantially themselves.

Investors should keep some cash and build some cash. I’ve sold stocks at a loss to make sure I have cash for when this market finally turns around. There’s some enormously attractive junior gold and silver mining companies out there, so investors need to keep liquid. Investors should find liquid companies that have valuable assets and can stay the course; companies with managements that are careful about how they structure their shares and their financings.

TGR: Jay, thank you for your time and your insights.

Read what other experts are saying about:

- Almaden Minerals Ltd.

- Balmoral Resources Ltd.

- Cayden Resources Inc.

- Columbus Gold Corp.

- Klondex Mines Ltd.

- Mandalay Resources Corp.

- Precipitate Gold Corp.

- TerraX Minerals Inc.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) Jay Taylor: I own, or my family owns, shares of the following companies mentioned in this interview: Cayden Resources Inc., Central Fund of Canada Ltd., Columbus Gold Corp., Cornerstone Capital Resources Inc., GoldQuest Mining Corp., Goldsource Mines, Novo Resources Corp., Paramount Gold and Silver Corp., Premier Gold Mines Ltd., SilverCrest Mines Inc. and TerraX Minerals Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I determined and had final say over what companies would be included in the interview based on my research, understanding of the sector and interview theme. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

3) The following companies mentioned in the interview are sponsors of Streetwise Reports: Cayden Resources Inc., Asanko Gold Inc., Almaden Resources Ltd., SilverCrest Mines Inc., Precipitate Gold Corp., Mandalay Resources Corp., Columbus Gold Corp., Klondex Mines Ltd., Premier Gold Mines Ltd., TerraX Minerals Inc. and Balmoral Resources Ltd. Goldcorp Inc. is not affiliated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert can speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.