By Cory

The Charts That Tell the Story of 2017 (So Far)

This is a great breakdown of what is actually happening in the US economy so far this year. There are a number of worrisome signs in the charts below but a couple positives that are contributing to the slow growth economy that the US, and world, is stuck in.

… Click here to visit the FactSet website for the original posting…

Over the first half of 2017, Insight examined many of the trends dominating the financial industry and making headlines. However, while headlines tell part of the story, nothing quite captures the movements of the market like data. Here, our panel of FactSet experts have selected the graphs and charts most evocative of the trends driving 2017 so far. Read on for an unadulterated look at the data behind the biggest stories of the year.

U.S. Economy

Sara B. Potter, CFA, CBE, VP, Market Analysis

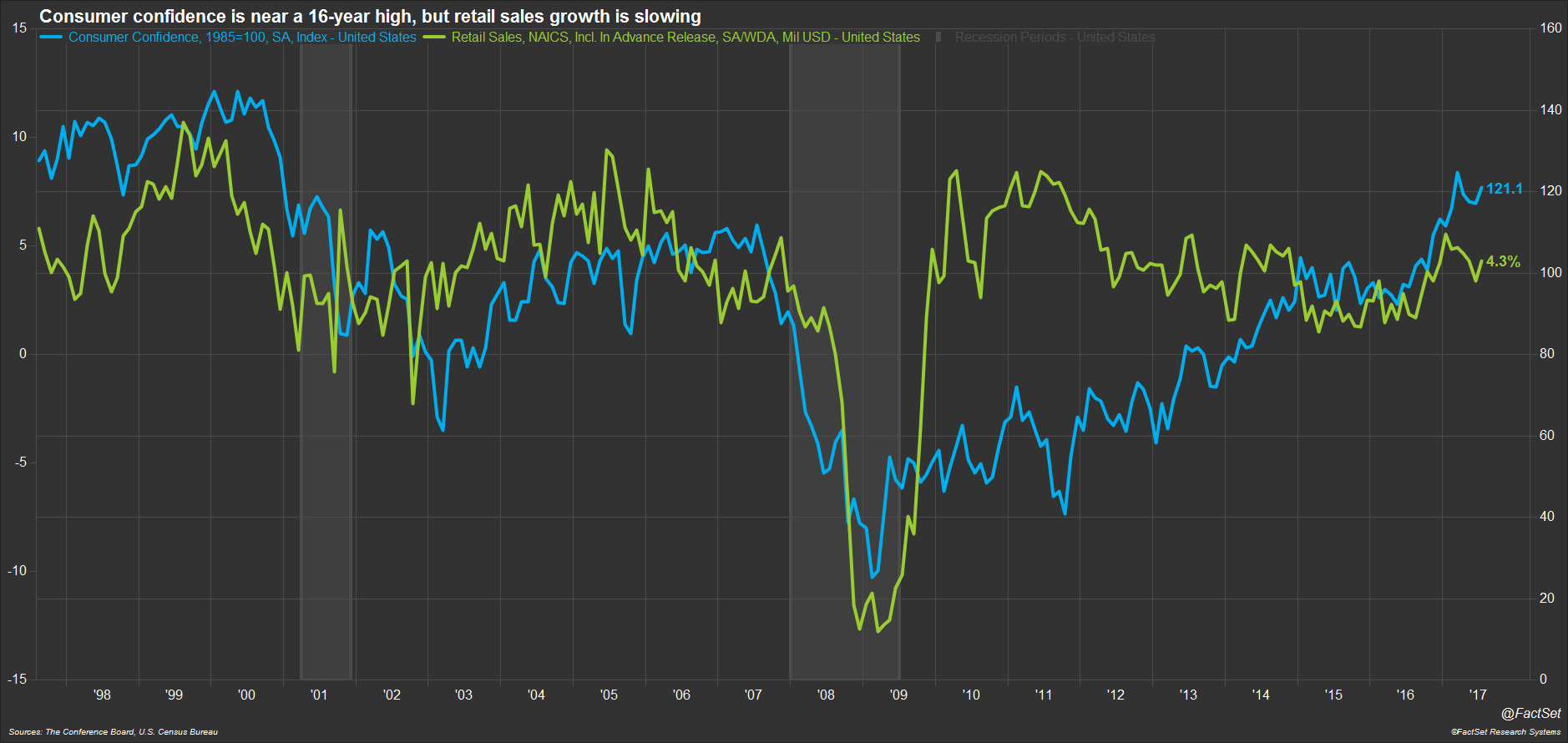

Consumer Spending is Not Keeping Up with Sentiment

FactSet clients: launch this chart

According to The Conference Board, consumer confidence reached a 16-year high in March 2017. The increase over the last several months appears to be driven largely by strong performance in the stock market and post-election enthusiasm. However, rising sentiment in the first half of the year was not matched by faster consumer spending growth, with retail sales growth underperforming in Q1 and Q2. We did see retail sales jump up in July, in sync with a jump in confidence, but we will have to wait to see whether this pattern holds for the remainder of the year.

Consumer Price Inflation Slows Even as Fed Rate Tightening Continues

FactSet clients: launch this chart

Following the largely commodity fueled jump in prices in January, both monthly CPI and PCE price indices have remained essentially flat in recent months. On a year-over-year basis, we are seeing steady declines in the growth rates for both measures, including their core counterparts. Given tightening labor markets, the Fed is keeping an eye on this data as part of their dual mandate to foster economic conditions that achieve both stable prices and maximum sustainable employment. Analysts surveyed by FactSet are predicting one more rate hike this year in Q4, in line with what is being predicted by futures prices.

Brick and Mortar Retail Stores Hurting while Internet Retail Surges

FactSet clients: launch this chart

The continuing trend away from traditional retail establishments and toward online shopping is having a significant impact on retail company performance. According to FactSet Market Indices, the total return for U.S. food retail companies is down 15.2% YTD and apparel/footwear retailers are down 12.7%. On the other hand, the FactSet index for internet retail companies is up 30.4% YTD.

Earnings

John Butters, VP, Senior Earnings Analyst

S&P 500 Companies with International Exposures Expect Higher Growth

Companies in the S&P 500 with more global revenue exposure are projected to report higher earnings and revenue growth in 2017 …read more

Source:: The Korelin Economics Report

The post Cory’s Insights – Fri 18 Aug, 2017 appeared first on Junior Mining Analyst.