Also contributing to gold’s price appreciation was lackluster economic data that, I believe, lowers the likelihood of another interest rate hike in 2017.

The yellow metal is now trading above its 50-day and 200-day moving averages, ordinarily seen as a bullish sign.

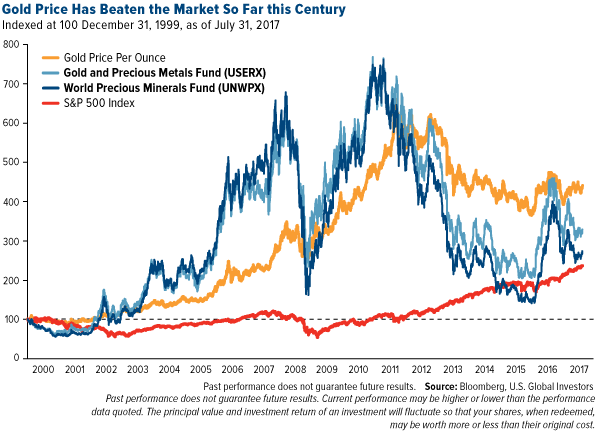

More impressively, the price of gold has outperformed the S&P 500 Index so far this century, returning 86 percent more than the market if we index both asset classes at 100 on December 31, 1999. Over the past 17 years, the S&P 500 has undergone two major contractions, both of them resulting in a loss of around 40 percent. Gold, meanwhile, has held its value well, boosting its appeal as a portfolio diversifier.

Our two gold funds have similarly outperformed the market so far this century, as you can see above. The

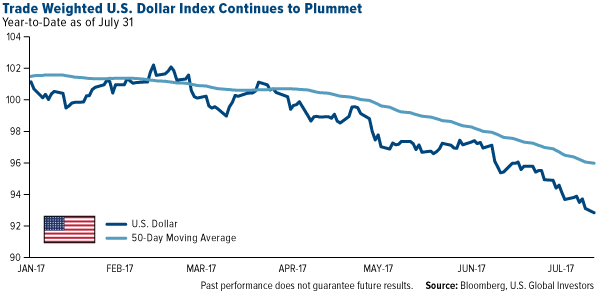

Spot gold finished July up more than 2 percent, its best month since February, when it returned 3.7 percent. The yellow metal responded to a struggling U.S. dollar, which has lost more than 10 percent so far this year relative to other currencies and is currently at a 15-month low. The dollar could very well continue to slide on additional political uncertainty surrounding President Donald Trump and his administration. This would mean further upside for gold and gold stocks.

click to enlarge

Also contributing to gold’s price appreciation was lackluster economic data that, I believe, lowers the likelihood of another interest rate hike in 2017.

The yellow metal is now trading above its 50-day and 200-day moving averages, ordinarily seen as a bullish sign.

click to enlarge

More impressively, the price of gold has outperformed the S&P 500 Index so far this century, returning 86 percent more than the market if we index both asset classes at 100 on December 31, 1999. Over the past 17 years, the S&P 500 has undergone two major contractions, both of them resulting in a loss of around 40 percent. Gold, meanwhile, has held its value well, boosting its appeal as a portfolio diversifier.

click to enlarge

Our two gold funds have similarly outperformed the market so far this century, as you can see above. The Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX) are co-managed by myself and precious metals expert Ralph Aldis. Not only do Ralph and I rely on fundamentals to make stock selection and weighting decisions, but we also maintain close, productive relationships with mining company management teams across the globe.

Gold Could Be the Solution for a Vulnerable Stock Market

In a telephone interview with Reuters this week, DoubleLine Capital CEO Jeffrey Gundlach, known on Wall Street as the “bond king,” said that he still has exposure to gold, which he predicts will see continued upward price momentum in the short term.

“Gold looks cheap compared to markets that have rallied a lot, including bitcoin and including Amazon,” said Gundlach, whose firm oversees $110 billion in assets.

Indeed, information technology stocks such as Amazon, Facebook, Apple, Microsoft, Google (Alphabet) and others—the imprecisely named FANG or FAAMG stocks—have been on a tear so far this year, propelling the market higher. This has been a detractor for gold, as many investors have moved out of “safe haven” assets and into risk assets.

I should point out, though, that the stocks I just mentioned disproportionately account for up to a third of the market’s gains in 2017, according to CNBC. As of August 1, the S&P 500 is up around 10.5 percent. But if we remove tech stocks, it’s up only 7.5 percent. The market is moving higher nearly every day, but on the backs of only five or so tech stocks. This makes the market particularly vulnerable, should those stocks see a correction, and adds to gold’s investment case as a potential store of value.

What’s …read more

Source:: Frank Talk

The post Surprise! Gold Prices Have Beaten the Market So Far this Century appeared first on Junior Mining Analyst.