By Brian Maher

This post Solved: The Case of the Missing Volatility appeared first on Daily Reckoning.

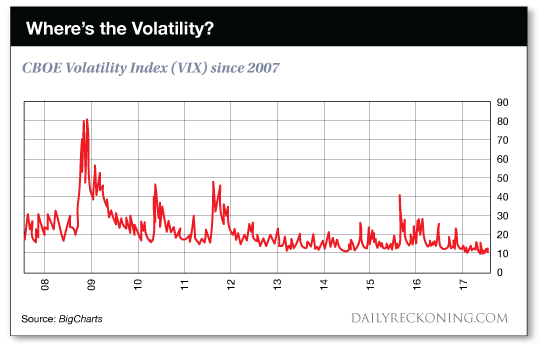

“Where has all the volatility gone?”

The lack of market volatility was a recurring theme at last week’s Natural Resource Symposium, hosted by Sprott in Vancouver.

Volatility hovers around historically low levels.

The VIX — Wall Street’s fear gauge — has closed below 10 on only 26 occasions since 2000.

Yet nine of these occasions have taken place since this April alone.

And volatility fell to an all-time low on July 26… to 8.84:

We might refer to the “calm before the storm” at this point.

Because we maintain a violent hostility toward the easy cliché, we won’t.

But put our little crotchet to one side…

When Jim Rickards took the podium last Friday, he said something about volatility that scratched lots of heads…

Yes, volatility seems at record lows, Jim confirmed.

But he said that in reality it isn’t.

Jim said volatility has simply migrated from the stock market to another market entirely… and no one’s noticed.

At that point, the crowd sat upright in its collective seat… tuned out all noise… and tuned in Jim…

Where has the volatility migrated?

Answer shortly.

Let us first peer into today’s market doings…

The Dow Jones industrial average ended the day 52 points higher than where it began.

It has now summited the 22,000 mark.

It seems only yesterday that it scaled 21,000.

Is 23,000 next?

The S&P gained one lonesome point today.

Meantime, the Nasdaq took a rare day off, closing the day down less than a point.

Amazon was down over $5 at one point today before scratching its way to breakeven.

Incidentally, Amazon has lost some 10% since tallying an all-time high last week — a portent of things to come?

Yes, stock market volatility is currently on furlough.

But it has not been eliminated, according to Jim Rickards.

Where is it hiding?

The currency markets.

“Volatility has shifted to the foreign exchange markets,” Jim told the Sprott conference.

Jim also presented a chart showing the dramatic price swings between the euro (EUR) and the dollar (USD).

Jim revealed the EUR/USD exchange rate has seen six separate moves of 20% or more in the past eight years.

He says these are “earthquakes” in a world of fourth-decimal-place pricing:

“Forex customarily trades in so-called ‘pips,’” says Jim, “which are measured at the fourth decimal place in an exchange rate. Lately we’ve seen moves of 1,000 pips per day.”

Jim’s also an expert in complexity theory. And he says complex systems like the currency markets are most vulnerable at times like this.

He told conference-goers this market is “highly unstable” and, employing a highly technical term… “wobbly.”

Perhaps you don’t think that concerns you.

But you do hold currency of one sort or another… we assume.

And as Jim notes, foreign exchange represents the world’s largest market.

Shouldn’t volatility in the world’s largest market arch an eyebrow here or there?

It hasn’t.

But currency volatility is a “scary thought,” says Jim, because the system has no anchor:

Currencies resemble boats with no moorings; they just drift around and occasionally crash into each other. The problem is that without moorings, they could all hit …read more

Source:: Daily Reckoning feed

The post Solved: The Case of the Missing Volatility appeared first on Junior Mining Analyst.