This post Amazon is the New Tech Crash appeared first on Daily Reckoning.

It won’t be long now. During the last 31 months the stock market mania has rapidly narrowed to just a handful of shooting stars.

At the forefront has been Amazon.com, Inc., which saw its stock price double from $285 per share in January 2015 to $575 by October of that year. It then doubled again to about $1,000 in the 21 months since.

By contrast, much of the stock market has remained in flat-earth land. For instance, those sections of the stock market that are tethered to the floundering real world economy have posted flat-lining earnings, or even sharp declines, as in the case of oil and gas.

Needless to say, the drastic market narrowing of the last 30 months has been accompanied by soaring price/earnings (PE) multiples among the handful of big winners. In the case of the so-called FAANGs + M (Facebook, Apple, Amazon, Netflix, Google and Microsoft), the group’s weighted average PE multiple has increased by some 50%.

The degree to which the casino’s speculative mania has been concentrated in the FAANGs + M can also be seen by contrasting them with the other 494 stocks in the S&P 500. The market cap of the index as a whole rose from $17.7 trillion in January 2015 to some $21.2 trillion at present, meaning that the FAANGs + M account for about 40% of the entire gain.

Stated differently, the market cap of the other 494 stocks rose from $16.0 trillion to $18.1 trillion during that 30-month period. That is, 13% versus the 82% gain of the six super-momentum stocks.

Moreover, if this concentrated $1.4 trillion gain in a handful of stocks sounds familiar that’s because this rodeo has been held before. The Four Horseman of Tech (Microsoft, Dell, Cisco and Intel) at the turn of the century saw their market cap soar from $850 billion to $1.65 trillion or by 94% during the manic months before the dotcom peak.

At the March 2000 peak, Microsoft’s PE multiple was 60X, Intel’s was 50X and Cisco’s hit 200X. Those nosebleed valuations were really not much different than Facebook today at 40X, Amazon at 190X and Netflix at 217X.

The truth is, even great companies do not escape drastic over-valuation during the blow-off stage of bubble peaks. Accordingly, two years later the Four Horseman as a group had shed $1.25 trillion or 75% of their valuation.

More importantly, this spectacular collapse was not due to a meltdown of their sales and profits. Like the FAANGs +M today, the Four Horseman were quasi-mature, big cap companies that never really stopped growing.

Now I’m targeting the very highest-flyer of the present bubble cycle, Amazon.

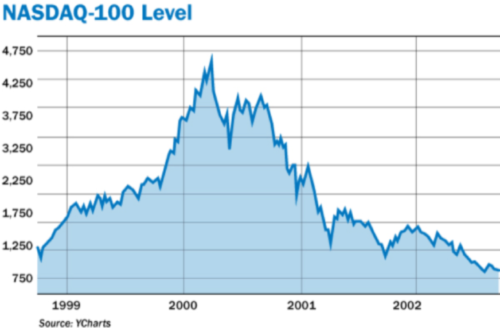

Just as the NASDAQ 100 doubled between October 1998 and October 1999, and then doubled again by March 2000, AMZN is in the midst of a similar speculative blow-off.

Not to be forgotten, however, is that one year after the March 2000 peak the NASDAQ 100 was down by 70%, and it ultimately bottomed …read more

Source:: Daily Reckoning feed

The post Amazon is the New Tech Crash appeared first on Junior Mining Analyst.