By Brian Maher

This post 100% Chance of Recession Within 7 Months? appeared first on Daily Reckoning.

We asked this question one week after Trump was elected:

“What does history predict for the Trump presidency?”

The answer we furnished — based on over a century of data — was this:

A 100% chance of recession within his first year.

Not a 90% chance, that is. Not even a 99% chance. But a 100% chance of recession.

That answer came by way of a certain Raoul Pal. He used to captain one of the largest hedge funds in the world.

And to prove his case he called the unimpeachable witness of history to the stand…

Crunching 107 years worth of data, he showed the U.S. economy enters or is in a recession every time a two-term president vacates the throne:

Since 1910, the U.S. economy is either in recession or enters a recession within 12 months in every single instance at the end of a two-term presidency… effecting a 100% chance of recession for the new president.

Obama was a two-term president — if memory serves.

Only two incoming presidents were not treated to a recession within the first year of office. And both followed one-term reigns:

Not every single election sees a recession, only every two-term incumbent change… Only two presidents in history did not see a recession, and they were inaugurated after single-term presidents.

Mr. Pal couldn’t fully explain the phenomenon.

Maybe it takes two terms for presidential mischief to work its way into the economic machinery.

One-term presidents just can’t heave enough sand in the gears.

Regardless of the reason, this fellow’s research pointed him to one conclusion:

“It is not a coincidence.”

Trump’s now five months into his first 12. Where does the prediction stand?

By grace of God or Janet Yellen or neither or both, no recession yet.

But our pessimistic side reminds us that seven months remain. And anxiety riles the deeps of our being…

For we’ve spotted ill omens… disturbing portents of recession among the recent economic data…

Old Daily Reckoning hand Wolf Richter:

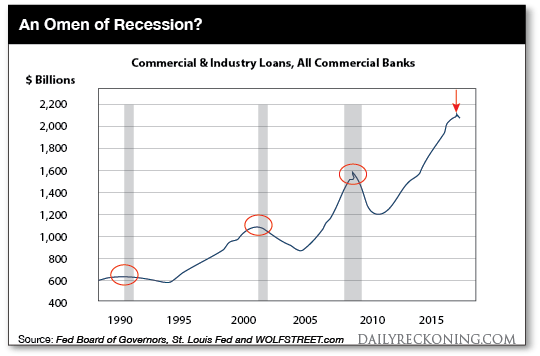

Over the past five decades, each time commercial and industrial loan balances at U.S. banks shrank or stalled… a recession was either already in progress or would start soon. There has been no exception since the 1960s. Last time this happened was during the financial crisis.

“Now,” Wolf says, “it’s happening again.”

Last month commercial and industrial loans (C&I) outstanding fell to $2.095 trillion, according to the St. Louis Fed. That’s down 4.5% from their November 2016 peak, says Wolf.

And it marked the 30th consecutive week of no growth in C&I loans.

Wolf argues C&I loans matter because they directly reflect the real economy — unlike today’s stock market, which is crooked as a Brit’s teeth.

Tuomas Maln is CEO of GnS Economics. He argues that today’s credit flows of commercial and industrial loans have not been this negative for 27 years… outside a recession anyway.

Sometimes credit flows turn negative before a recession, he notes. And sometimes after.

During the 2008 crisis for example, Malinen notes that …read more

Source:: Daily Reckoning feed

The post 100% Chance of Recession Within 7 Months? appeared first on Junior Mining Analyst.