By Jeff Reeves

InvestorPlace.com

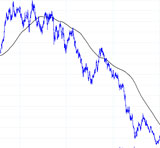

Gold prices have had a nasty few years, as have major gold miners and mining stocks. Gold bullion prices are down significantly from highs around $1,900 an ounce — and even worse, gold investments including Newmont (NEM), Barrick Gold (ABX) and GoldCorp (GG) are all down over 50% in the last three years.

Gold prices have had a nasty few years, as have major gold miners and mining stocks. Gold bullion prices are down significantly from highs around $1,900 an ounce — and even worse, gold investments including Newmont (NEM), Barrick Gold (ABX) and GoldCorp (GG) are all down over 50% in the last three years.

But there are signals that the worst may now be over, and it may be a good sign to start buying gold once more.

Since January, gold has crept up steadily; the SPDR Gold Trust (GLD), which tracks physical gold prices, is sitting on a roughly 10% gain — nearly double the return of the S&P 500 in the same period.

For the record, I am no Peter Schiff here with delusions of gold hitting $5,000 as the stock market implodes and inflation runs wild. But I think it’s undeniable that the short term trends are decidedly higher for gold mining stocks and gold bullion prices.

Here’s why: