By Cory

What’s next for the Dollar, Gold & Stocks?

A question we all ask ourselves almost everyday is where is the dollar, gold and stocks going. In the post below Axel outlines his thoughts on the sectors mentioned above as well as bonds and other currencies. He draws some interesting similarities to stocks now vs 1987 which I found interesting.

Axel’s thoughts on gold are very much in line with what I think will drive the metals higher. Real rates are going to stay negative and the market is understanding that. That does not mean a straight shot up but more of a climb as the markets comes to understand that real rates will stay negative for years to come.

Click here to visit Axel’s site for more great articles.

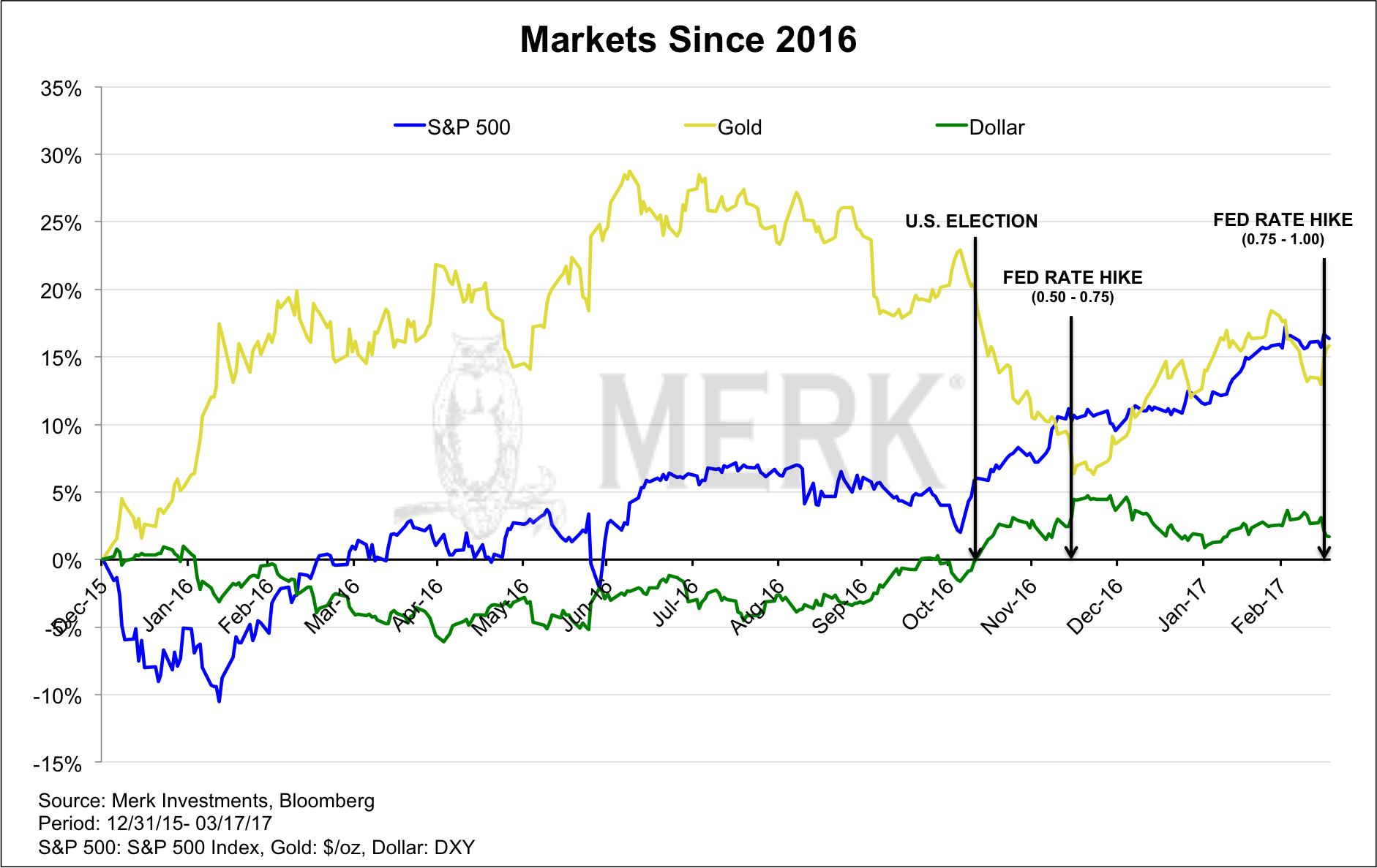

Two rate hikes since last year have weakened the dollar. Why is that, and what’s ahead for dollar, currencies & gold? And while we are at it, we’ll chime in on what may be in store for the stock market…

Stocks…

The chart above shows the S&P 500, the price of gold and the U.S. dollar index since the beginning of 2016. The year 2016 started with a rout in the equity markets which was soon forgotten, allowing the multi-year bull market to continue. After last November’s election we have had the onset of what some refer to as the Trump rally. Volatility in the stock market has come down to what may be historic lows. Of late, many trading days appear to start on a down note, although late day rallies (possibly due to retail money flowing into index funds) are quite common.

Where do stocks go from here? Of late, we have heard outspoken money manager Jeff Gundlach suggests that bear markets only happen if the economy turns down; and that his indicators suggest that there’s no recession in sight. We agree that bear markets are more commonly associated with recessions, but with due respect to Mr. Gundlach, the October 1987 crash is a notable exception. The 1987 crash was an environment that suffered mostly from valuations that had gotten too high; an environment where nothing could possibly go wrong: the concept of “portfolio insurance” was en vogue at the time. Without going into detail of how portfolio insurance worked, let it be said that it relied on market liquidity. The market took a serious nosedive when the linkage between the S&P futures markets and their underlying stocks broke down.

I mention these as I see many parallels to 1987, including what I would call an outsized reliance on market liquidity ensuring that this bull market continues its rise without being disrupted by a flash crash or some a type of crash awaiting to get a label. Mind you, it’s extraordinarily difficult to get the timing right on a crash; that doesn’t mean one shouldn’t prepare for the risk.

Bonds…

If I don’t like stocks, what about bonds. While short-term rates have been moving higher, longer-term rates have been trading in a narrow trading …read more

Source:: The Korelin Economics Report

The post Axel Merk – Insights on the Economy – Wed 22 Mar, 2017 appeared first on Junior Mining Analyst.