![]() By Mike Swanson on Tue, 05/12/2015 – 06:43

By Mike Swanson on Tue, 05/12/2015 – 06:43

All markets go through cycles and gold is going to start a new bull market before anyone realizes it.

And right now everyone is asleep when it comes to gold.

Gold last made a peak in 2011 and then had a crash drop in 2013 while the mining stocks had a big decline last year.

Those losses have made gold bugs give up.

I know markets can be hard for people. I got in gold and mining stocks last summer and had to get in and out for some losses. But if you were interested in gold in the past or own some you cannot give up now when something big is around the corner now.

Almost no one is bullish on gold and despite talking about gold a lot I hardly ever even get emails about it.

Most of the masses are simply bullish on the stock market.

What happens is people are bullish on the markets that have gone up over the past six months the most and end up chasing so they never get in early on anything.

So people rather try to jump in YELP.

And since gold and mining stocks have been going sideways now since the Fall people are no longer paying much attention to them and CNBC never talks about them.

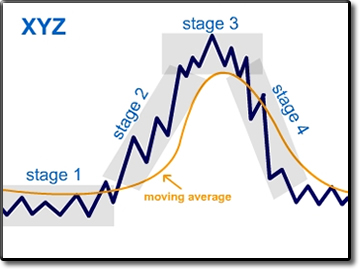

But stage analysis can help you understand what is happening with metals and mining stocks.

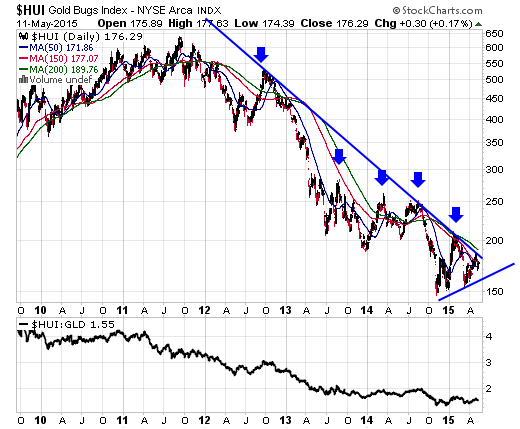

This is a chart of the HUI mining stock index.

The HUI topped out in 2011 and completed a stage three top by the end of that year.

It then had a decline in 2012 and a crash in 2013.

It then tried to bottom in 2014, but then made new lows in a crash bottom last October.

It has since been going sideways in a stage one base.

In a stage one base the moving averages flatten out and volatility shrinks.

The stage one basing phase ends when the market goes through its 200-day moving averages in a decisive manner.

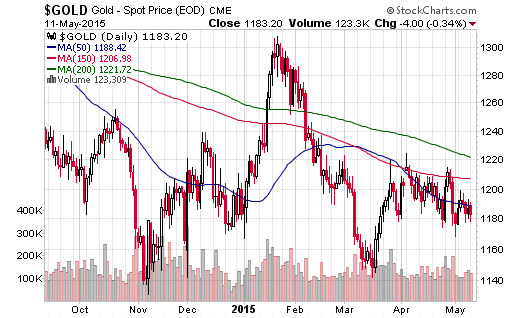

At the moment gold, silver, and the mining stocks are all consolidating below their 200-day moving averages.

In a stage two bull market those moving averages act as support and in a stage three bear market they act as resistance.

We are a transition period that will come to an end soon.

I cannot predict the exact timing of this though.

It could be days or weeks or a few months.

I can tell you this though no one is paying attention right now.

There is one thing I want you to notice on the chart, because it can help you the most.

I put those blue arrows to show when the past rallies topped out.

Notice that each arrow is lower than the last, which shows that each rally peaked out a lower point than its previous one.

A bull market is also defined by one making higher highs so once the HUI goes through 209 people will recognize a new bull market and some will buy to get in.

You see that was the HUI’s peak in January.

But the last peak in April is really more important. It was made at 187.

So the key level to watch now though is the 187-189 zone, which is the point of the April high in the HUI and its 200-day moving average.

One the HUI goes through this level it will begin a new bull market.

Keep your eyes on the 189 price point on the HUI.

For gold the key price point is now $1,221, which is the point of gold’s 200-day moving average.

Now it will probably take a rally above $1,300 in gold for the masses to realize what is starting in gold, but it will be a close above $1,220 that makes the new bull market begin.

You can make a fortune armed with this knowledge while most people try to play the crazy up and down gyrations in the US stock market (the DOW and S&P 500 have done nothing, but go sideways since Thanksgiving) and ignore a market going into a new bull market.

This is a year of transition in which new bull markets will begin and new bear markets will too that will take people by surprise by the time they realize what is happening.

But those who understand what is coming and how to play things will make a killing.

Join us for exciting opportunities in all investment

sectors with long-term warrants.