After a relatively long period without significant news, Terraco Gold seems to have shifted a gear now, so The Critical Investor sat down with CEO Todd Hilditch for a company update.

Meeting in Vancouver around the latest VRIC show, I felt it was an opportune time to interview Terraco Gold Corp.’s (TEN:TSX.V; TCEGF:OTCPK) CEO Todd Hilditch on a number of subjects. First Paul Zink, a royalty veteran was contracted, and shortly afterwards on February 1 an additional royalty was acquired from the Schmidt Family Mining Partnership LLC on the Spring Valley Gold Project in Nevada. This is a 0.5% Net Smelter Returns royalty (NSR royalty) on lands within a one-half mile perimeter of the Schmidt Claim Block. Red Kite Mine Finance also had a right to, and purchased, an identical royalty on the same lands, for the same price, USD$567,895. Furthermore, according to the news release:

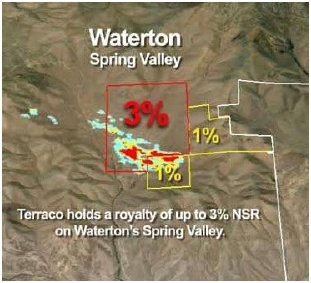

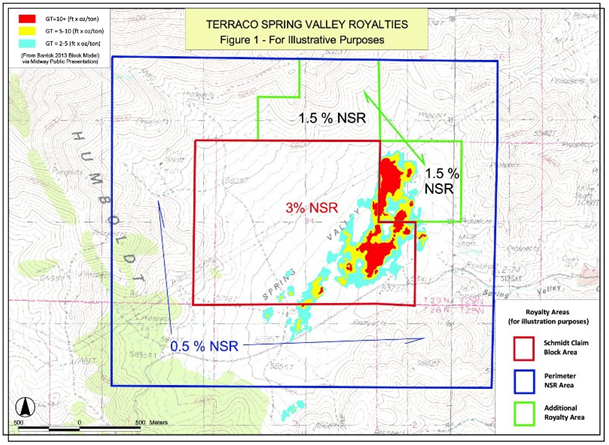

“Terraco currently owns a 3% NSR royalty on the Schmidt Claim Block covering a majority of the known gold resource at Spring Valley, as well as a 1% NSR royalty on adjoining additional lands to the Schmidt Claim Block (the “Additional Royalty Area”3 ) covering the northeast portion of the known gold resource at Spring Valley. The acquisition of the Perimeter NSR adds new royalty coverage on areas beyond the Schmidt Claim Block and further increases Terraco’s Additional Royalty Area to 1.5% NSR. The Perimeter NSR also adds brand new royalty coverage on the southern portion of the Spring Valley resource where Barrick Gold Corp. (“Barrick”) previously completed step out drilling outlining further evidence for the potential to expand Spring Valley’s resource base.”

I found it particularly interesting to see this royalty increase the existing 1% royalties to 1.5%, as one part of those covers about a third of the delineated Spring Valley deposit. Before the transaction:

After the transaction:

In reviewing drill results from the old operator/owner of Barrick and Midway Gold, management believes that investors may have forgotten about some of the late stage Barrick drilling at Spring Valley (Midway news releases in 2012/13) because of the Midway bankruptcy. As an example, the majority of the deposit and where Terraco has a 3% royalty (Schmidt Claim Block), drill holes included 361m of 1.47gpt gold including 21m of 7.54 gpt, 116m of 1.58 gpt gold including 27m if 11.66 gpt.

No wonder, Terraco continues to be excited about Spring Valley and happy to add more if it can. Management explained to me this new royalty acquisition is about land that has seen some very significant drilling and showed high grade areas of the deposit that included 120m of 2.26 gpt gold and 105m of 0.96 gpt, 85m of 1.58 gpt.

From the back of an envelope, this transaction looks cheap to me, and I’m interested to hear from CEO Todd Hilditch what his thoughts are about adding value versus acquisition costs. Another development or rather non-development I would like to discuss in this interview is the apparent delay of the Nutmeg PEA, which was due in Q4 2016, later on in December 2016, and at the start of February 2017 there is still no sign of a PEA, so I would like to get some sort of status update on this too, if possible of course.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The Critical Investor: Nice to have you available to answer a number of questions for the audience, Todd. Let’s kick off with the first question. Looking at this new royalty deal, does new hire Paul Zink already had something to do with this, possibly already visualizing his added value, or is this a deal set up and finalized well before he got on board?

Todd Hilditch: This new acquisition was part of a structure I negotiated with Mr. Schmidt, who owned the Spring Valley royalty, long before Paul joined us. As Spring Valley was at its early stage of exploration but showing great promise, I thought it was important to help Terraco cover the growth potential beyond the Schmidt claim block. At the time we didn’t know that it would represent a significant portion of the currently known ore body but we did want to ensure Terraco would cover the growth potential at Spring Valley, so in our minds by negotiating a right of first refusal on the Schmidt claims in 2011 we (when exercised and just did) would have upside in royalty coverage no matter which way the deposit grew (i.e., east, west, north, south or at depth). Paul recognizes the value of what we created on Spring Valley in this right-of-first-refusal transaction.

TCI: As mentioned in my introduction of this interview, could you indicate to us a back of the envelope estimate of possible value-add for the 0.5% royalty increase on the part that covers the Spring Valley Gold deposit, versus the approximate amount you paid for this?

TH: When we originally structured the transaction in 2011, our value creation on Spring Valley as a whole started with Terraco buying (through the royalty) gold between $200 and $300 per ounce based on the Spring Valley NI43-101 at the time. Since then and under Barrick’s development work outlined in our press release, we believe strongly that the deposit has grown and the drill results have proven our confidence that Spring Valley is expected to be a mine. This is substantiated by Barrick’s presentation, prior to the sale, of Spring Valley being PFS 2016 fast track project. The price we have paid historically as well as this new purchased royalty drives blends our cost per ounce lower.

Going forward, at no cost to us, the cash flow from this royalty is expected to be significant and well in excess of what we paid. By way of example and very simplistic and roughly estimated: 5m oz X 80% (recoveries guesstimate) X 30% (royalty coverage guesstimate) X 0.5% (recent NSR purchase) = 6000 payable ounces (rough and dirty) X gold price of for example $1250 =$7.5m USD. This would imply in theory a 15X return on our investment, and this is assuming no additional ounces found. Our return could be greater depending on inputs but this is a rough math number on why it made a lot of sense to us and Red Kite to do this deal, and this is just for the new NSR. When you put them all together the sum of parts NAV has increased a lot.

TCI: We see your new transaction adding to the Spring Valley royalty package, can you tell us about Red Kite and why they are there?

TH: In 2011 when I negotiated the terms of the Spring Valley royalty purchase with Mr. Schmidt, Terraco required a funding package to complete the deal. Red Kite, through subsidiary RK Mine Finance, funded the original Schmidt royalty transaction. Red Kite clearly saw the value in Spring Valley and the royalty package which included an option with Terraco to purchase 50% of the perimeter royalty along with Terraco on the same terms as we paid in the right of first refusal.

TCI: Why would Red Kite participate in the royalty transaction considering Waterton is quiet on news for SV? Don’t they usually want more influence on outcomes of investments?

TH: I can’t comment on Red Kite’s investment protocol relating to influence on their investments but I would have to assume that the transaction and price Terraco, and thus them, made sense in their investment criteria. Red Kite has over $2B under management and a long history in the mining industry of making good investment decisions (as does Waterton) so regardless of whether Waterton publicly announces information on Spring Valley advancement or not, I would assume Red Kite (along with us) believe strongly in the development potential and royalty economics of Spring Valley so news and timing isn’t as critical

TCI: Does Red Kite own other royalties in the area? I’m not really familiar with them holding royalties or streams besides this project.

TH: I am not aware of Red Kite holding any other royalties in the area or any jurisdiction for that matter but wouldn’t know definitively.

TCI: Despite we both know that Waterton isn’t really forthcoming with news on assets in general, have you heard anything about Waterton’s plans at Spring Valley in the meantime?

TH: I can’t comment on what Waterton is doing at Spring Valley but I can confirm that the folks that run Waterton are very sharp people and they have made a lot of money by buying mining assets, investing in their development and improvement, and then selling them to producers. A good recent example is Waterton’s purchase of the Hollister Mine a couple years ago (I believe it was from bankruptcy), then investing approx $19m in development and improvement before selling to a producer Klondex for $100m. I don’t expect anything different with Spring Valley, i.e., bought it, improve it and possibly sell it to a major. Their model is excellent and it works.

TCI: Will their business model eventually work for Terraco shareholders?

TH: I think their business model will work for us as well. I doubt they expect to sell Spring Valley at a significant premium to a major mining company without improving and advancing the project whether that is with additional drilling, permitting, mine planning, infrastructure, etc. I suspect that work is going on and that one day soon we will either wake up to an announcement of work they are doing /have done or that Spring Valley is sold to a major like Newmont or Kinross or someone else. I would bet our royalty holdings and company would be adjusted upwards in relation to a major coming in. . .so, yes, I think their model will work for us we just need a little more patience.

TCI: As mentioned in my introduction, I noticed the Nutmeg PEA, which I view as an important catalyst for Terraco, wasn’t released in 2016. Is there a specific reason for this, and if so, could you elaborate on as much as possible?

TH: There are a few reasons and relate to priorities. First, our focus on advancing the royalty portfolio including this transaction took several months to complete thus taking time away from other work. Second, we decided to spend more time on the recoveries aspects of the deposit including review of additional crushing methods and potential high pressure grinding and if utilizing this method would help in liberating more gold. We recently initiated some test that will take a few months to complete. These results will help us decide our path and timing for moving towards any economic studies.

TCI: Do you think you can give any indication when the Nutmeg PEA can be expected?

TH: Unfortunately not yet, it will depend on the HPGR tests (high pressure grind).

TCI: The share price has come off quite a bit since I initiated coverage, predominantly on lower gold, but is recovering now as gold seems to get stronger again. Where do you see gold and Terraco heading for in 2017 and for the longer term, and why?

TH: We continue to examine and complete due diligence on possible royalty purchases that I hope will add other royalties in addition to Spring Valley to our portfolio. With our current royalties, advancement of Spring Valley (sale or other news), additional royalties and all in conjunction with a higher gold price I would expect our value to increase. My gut feel is gold will move higher in 2017 with many uncertainties globally that would contribute to a lift in the yellow metal.

TCI: Thank you, Todd, for answering these questions, which will probably provide more insight in the Terraco Gold story to readers and current investors. I’m looking forward to what Paul Zink could bring to the table this year, I know you are always chasing new deals so this could be interesting to follow as well, and I hope to see positive test results for Nutmeg, and in that case the PEA results soon afterwards.

Rochester Mine owned by Coeur Mines, adjacent to Spring Valley Gold project; Nevada

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long term commodity pricing/market sentiments, and often looking for long term deep value.

Getting burned in the past himself at junior mining investments by following overly positive sources which more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The Critical Investor Disclaimer: The author is not a registered investment advisor, and currently does not have a position in this stock. Terraco Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to terracogold.com and read the company’s profile and official documents on sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

2) The following company mentioned in the article is a billboard sponsor of Streetwise Reports: Terraco Gold Corp. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

( Companies Mentioned: TEN:TSX.V; TCEGF:OTCPK,

)