Chile’s mining minister Baldo Prokurica asked the London Metals Exchange (LME) Wednesday to consider trading the coveted metal used in the batteries that power electric vehicles (EVs) and high-tech devices, and so provide greater “clarity” about its value.

Chile produced 80,000 tonnes of lithium carbonate equivalent last year, representing 35 percent of global production.

On his first visit to Britain after taking office in March of this year, Prokurica met with local companies about potential partnerships with state-miner Codelco to eventually produce value-added lithium products, EFE news agency reports.

In July, the LME asked companies that assess prices of battery-grade lithium to submit proposals to supply a reference for cash-settled contracts it plans to launch next year. Currently, producers negotiate contracts with buyers, but the terms of the deals are not made public.

“We want to generate conditions for our products to be sold in a transparent manner, and that raises the possibility that lithium be traded on the LME so there can be clarity about its value,” the minister said, according to Chilean paper Estrategia.

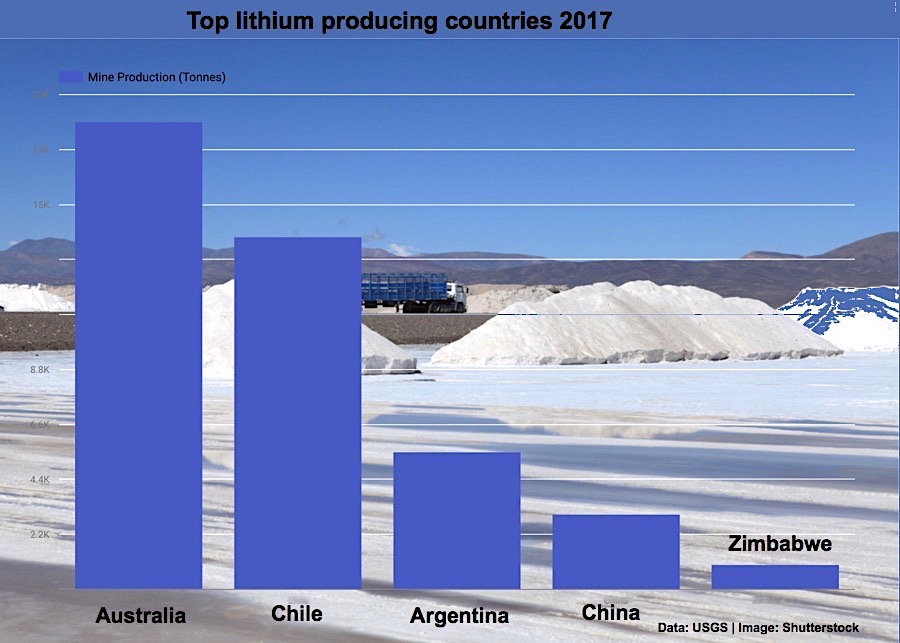

Already the world’s top copper producer, Chile holds about 48% of the known lithium reserves, and it’s the second largest miner of the metal, after Australia, with 80,000 tonnes of lithium carbonate equivalent produced last year. But both companies and the government are working hard on reversing that.

Copyright: MINING.com.

Over the past several months, Chile’s SQM — the world’s number two lithium producer — has been expanding its mines. The company recently finished the first stage of a lithium carbonate ramp-up in Chile’s Salar del Carmen, reaching a capacity of 70k million tonnes a year.

“Our next step will be to work towards our goal of 120k MT/year, which is expected to be completed by the end of 2019,” chief executive officer Patricio de Solminihac said in August.

The firm actually believes it will soon overtake US-based competitor Albemarle as the world’s top lithium miner, by 2022 to be exact. SQM would boost production capacity that year to 28% of the world’s total versus Albemarle’s 16%.

Chile expects lithium to soon become its second largest mining asset, just behind copper. It’s currently the country’s fourth biggest export.

The post Chile wants lithium to be traded on LME appeared first on MINING.com.

From:: Infomine